Economic Reports Due out (Times are EST): FOMC Meeting Begins, ICSC-Goldman Store Sales (7:45am), Housing Starts (8:30am), Redbook (8:55am)

Pre-market Update (Updated 8:00am eastern):

- US futures are slightly higher.

- European markets are trading 0.5% higher.

- Asian markets traded on average -0.4% lower.

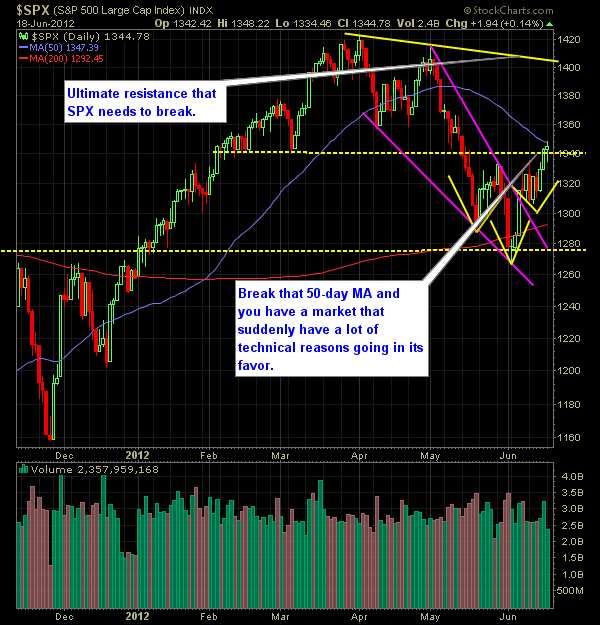

Technical Outlook (SPX):

- Yesterday provided us with sideways price action, with a slight bullish tilt to it.

- 50-day moving average stopped any hopes of a rally – and will be key resistance for today.

- 1346 represents where the moving average will be at today, and where the S&P will need to break through. Today’s slight strength ahead of the bell could see an open above that price level.

- We are right back in overbought territory, but the thing is, if the market is indeed on a strong run, it can stay in this area, for quite a while.

- A healthy sign for the market is that we are just below the upper-band of the Bollinger Bands (not out side of it) and riding the upper band nicely higher now.

- There is now an established uptrend in place on SPX off of the 6/4 lows with consecuitive higher-highs and higher-lows now (two of each).

- FOMC Statement to be issued tomorrow, which could stir up market rumors of QE3 (though I doubt it).

- Quite a ways from current price, but ultimately, if the price can clear 1401 we’ll have a market that is very bullish.

- Represents the slightly descending resistance level off of the 4/2/12 highs.

- SPX confirmed the inverse head and shoulders pattern on Friday.

- Of late, respectable support lies at the 10-day moving average.

- Has touched it multiple times in the past 2 weeks and held each time.

- IH&S pattern very obvious on the 30-minute chart.

- Confirmed on Friday.

- Volume remains relatively average.

- The markets in general have pulled back roughly 10% off of its recent highs which is typically considered a “pullback” in the markets.

- Measured by recent highs to its most recent lows.

- A break below 1306 would represent a resumption of the downward trend.

- The VIX had one of its worst days in a long long time – dropping over 13% and pushing it back below 20 at 18.32. This is a very bullish sign for the market, as fear is starting to leave the markets.

My Opinions & Trades:

- I don’t see, based on the charts, any notable reasons to be short this market.

- I can tell you a million economic/fundamental reasons, but as a chartist, I have to leave personal biases behind, and simplify read the charts.

- With a total of 6 long positions, I may look to push it to 7, but more than likely I would look to switch out non-performers with new ones I believe hold more opportunity to them.

- Careful about trading in and out of this market too much – I’m playing with my original stop-losses which is usually 3-4% off of the entry price and gives me enough wiggle room to weather the choppiness of this market day-to-day.

- Bought AMZN at $221.60.

- Bought BXS at $13.71.

- I am still long PPL at $27.65, PCYC at $40.66, WNR at $20.51, VCI at $19.41

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.