Pre-market update (updated 8:30am eastern):

- European markets are trading -0.7% lower.

- Asian markets finished -1.4% lower on the day.

- US futures are trading moderately lower ahead of the bell.

Economic reports due out (all times are eastern): Jobless Claims (8:30am), Jobless Claims (8:30am), PMI Manufacturing Index Flash (8:58am), Philadelphia Fed Survey (10am), Leading Indicators (10am), EIA Natural Gas Report (10am)

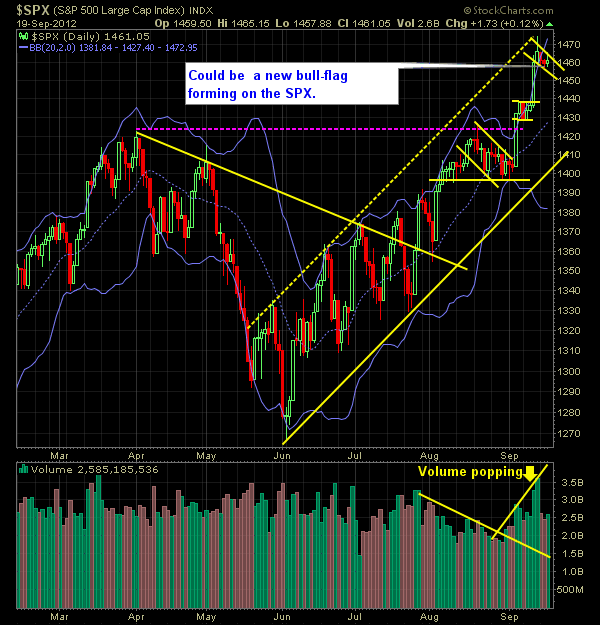

Technical Outlook (SPX):

- Yesterday offered the market some nice consolidation, and the possibility of forming another bull-flag on the daily SPX chart.

- With the 7-8 point gap down in SPX, these gap downs tend to be difficult for the bears to capitalize on, and instead, what you see is the bulls, often times, buy the weakness after the first hour of trading.

- We could see some increased selling if we were to drop below Tuesday’s lows at 1456.

- Volume dropped further yesterday, which is not uncommon during pullbacks or consolidation periods in the market.

- The pullback that has occurred so far this week, has allowed the market to come off of oversold levels as well.

- No signs of panic in this market during the recent pullback.

- On the 30-minute chart – its a tale of two charts: either we are forming a bull flag or just formed a lower-high.

- Fed’s QE3 launch is going to add a lot of buying power to this market and drive more people out of interest-bearing assets and into equities in search of some kind of return.

- Going back years, there really is little in the way of resistance for the markets until it tests 1500.

- Resistance at 1437 and 1440 was broken with little problem and now becomes support.

- Upward trend-line off of the 6/4 lows has rising support at 1406.

- SharePlanner Reversal Indicator confirmed the move higher this past week.

- VIX dropped below 14.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- If another sell-off were to ensue, watch for a break and close below 1396 for a new lower-low in the market.

My Opinions & Trades:

- Sold 1/2 of GTAT position at $7.01 from $6.73 for a 4.2% gain.

- Bought PNR at $43.85.

- Bought IACI at $52.59.

- Current stop-losses have been adjusted across the board.

- ALXN stop-loss moved up to $110.00

- Stop-loss for NLSN at $29.30.

- Stop-Loss for WYNN increased to $111.50.

- Stop-Loss for BEAV adjusted to $40.90.

- Stop-loss for GTAT adjusted to $6.67.

- Remain long SHLD at $61.10, GTAT at $6.73 (1/2), BEAV at $40.75, WYNN at $107.47, NLSN at $28.70, and ALXN at $102.53

- Track my portfolio RealTime here.

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.