Pre-market update (updated 8:30am eastern):

- European markets are trading mixed but 0.3% higher. .

- Asian markets finished 1.4% higher.

- US futures are trading moderately higher ahead of the bell.

Economic reports due out (all times are eastern): FOMC Meeting Begins, MBA Purchase Applications (7am), Import and Export Prices (8:30am), Wholesale Trade (10am), EIA Petroleum Status Report (10:30am)

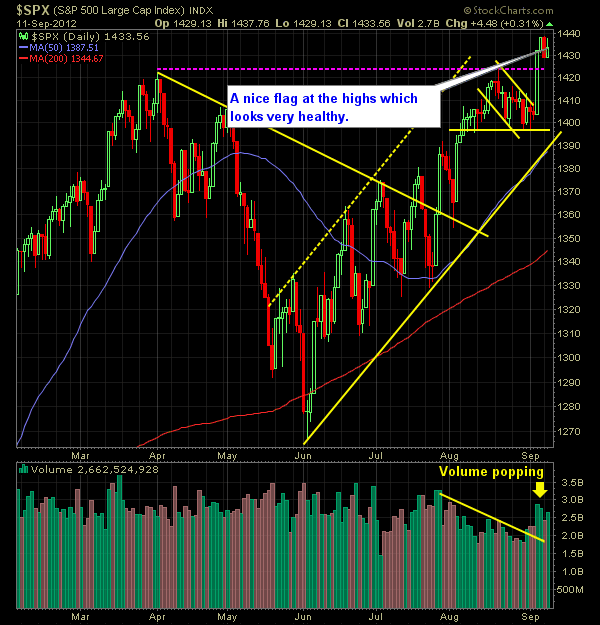

Technical Outlook (SPX):

- Nice recovery yesterday after the previous day’s sell-off.

- Creates somewhat of a mini bull-flag pattern on the daily SPX.

- Volume seems to be picking up ‘some’ as we head into the final stretch of Q3 and into Q4.

- Upward trend-line off of the 6/4 lows has rising support at 1400.

- Near-term resistance is at 1437. Additional Buying power should flow in once we break that level.

- If we pullback today, look for some dip buying opportunities around 1419.

- We are overbought as of yesterday’s close.

- Test at 1440 resistance is in play today. While there isn’t a lot of resistance overhead, this is a minor resistance level worth noting.

- SharePlanner Reversal Indicator shows a bearish divergence which is worth noting.

- FOMC Statement occurs on an unusual Thursday at 12:30pm est (typically Tuesday or Wednesday).

- 30-min chart shows a nice uptrend now in place with higher-highs and higher-lows.

- VIX surged yesterday and now back above 16.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- If another sell-off were to ensue, watch for a break and close below 1396 for a new lower-low in the market.

My Opinions & Trades:

- Took a long position in CRR at $72.27.

- Bought QIHU at $24.00

- Sold ALXA at $4.84 from $4.83 for a 0.2% gain.

- Sold CROX at $18.22 from $17.39 for a 4.8% gain.

- Looking to add 1-2 new positions today. May be open to 1 short hedge as well.

- Current stop-losses have been adjusted across the board.

- ALXN stop-loss moved up to $108.00

- Stop-loss for FBHS at $25.70.

- Stop-Loss for V at $125.85

- Remain long V at $127.18, FBHS at $24.54, and ALXN at $102.53

- Track my portfolio RealTime here.

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Each year I like to take a moment to reflect on my swing trading from the prior year. The 2025 trading year offered a lot to be happy about, but it also changed my views in a number of ways and gave me some lessons to take from it, as well as some new perspectives to take into 2026 as I navigate the stock market for yet another year. I'm hoping this moment of reflection in this podcast episode will be as beneficial for you as it was for me in making it.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.