Economic Reports Due out (Times are EST): Jobless Claims (8:30am), Ben Bernanke Speaks (10am), Quarterly Services Survey (10am), EIA Natural Gas Report (10:30am), Consumer Credit (3pm)

Premarket Update (Updated 7:30am eastern):

- US futures are up moderately ahead of the open.

- European markets are trading 1.3% higher.

- Asian markets traded on average 1.3% higher.

Technical Outlook (SPX):

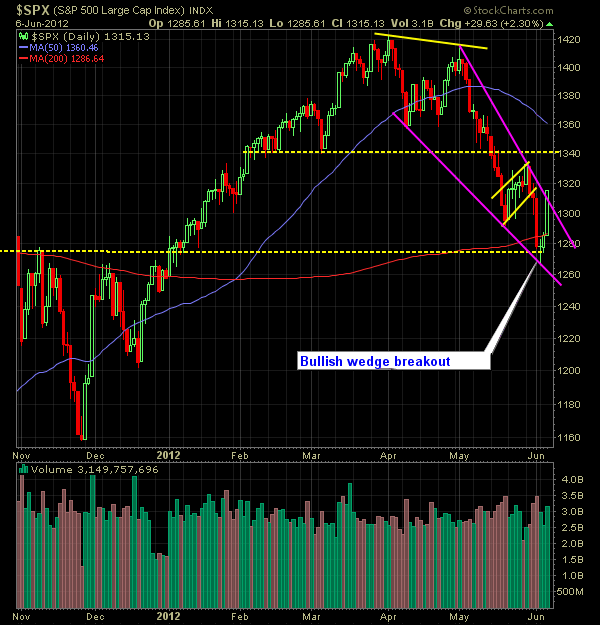

- Huge day for the S&P yesterday as it managed to climb back out of the downward trend-line at 1310 and breakthrough the bullish wedge that had been forming.

- Next key resistance level for the S&P to break through would be 1335.

- Market is well off of oversold conditions after yesterday’s bounce.

- S&P crossed back above the 10-day moving average, and a shade below the 20-day moving average. The latter of the moving averages has been problematic for the bulls to cross above recently.

- Major bottoms or at the least, interim bottoms, tend to make huge gains in the initials days following the bottom. See last October and September 2010.

- Minor support at 1249, 1209 would also represent a level of price support, should we close below 1275 support. .

- 30-minute chart looks to reverse the current downtrend.

- Nearest level of resistance for the S&P is at 1334 and 1340 and then again at 1357.

- VIX is still elevated and rests above 24.

My Opinions & Trades:

- Don’t be too anxious to re-short this market – let this bounce play itself out. Could very well be forming a bottom, don’t discount the possibility.

- Risk is elevated for new positions to the short-side.

- Long PPL at $27.65

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.