Economic Reports Due out (Times are EST): Employment Situation (8:30am), Personal Income and Outlays (8:30am), PMI Manufacturing Index (9am), ISM Manufacturing Index (10am), Construction Spending (10am)

Premarket Update (Updated 8:30am eastern):

- US futures are flat and off their overnight highs prior to the open.

- European markets are trading -2.0% lower. .

- Asian markets traded on average -0.7% lower.

Technical Outlook (SPX):

- We saw the SPX recover from most of its losses yesterday to close a shade below breakeven.

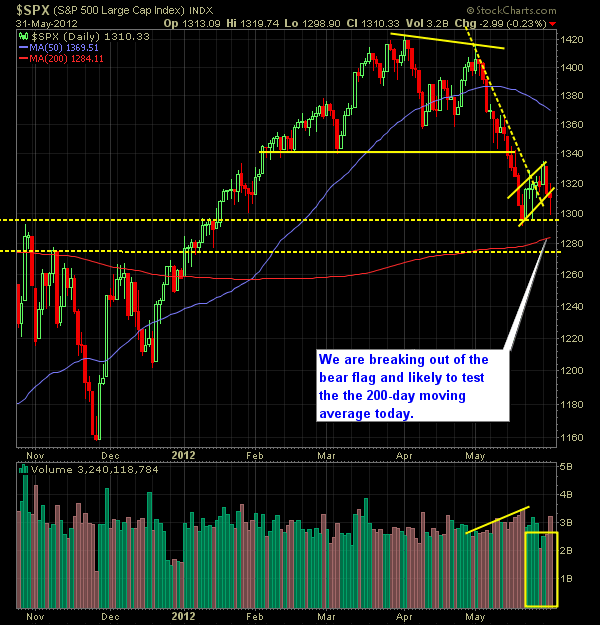

- Huge miss on employment number has us down near 2% at the open today, and a confirmed breakout of the bear-flag pattern that had been developing.

- S&P is poised to test the 200-day moving average today at the open, which we haven’t been below since December of last year.

- Large gap downs, such as what we are seeing this morning, have a difficulty of holding at their intraday-lows and often times will bounce creating a short-squeeze effect.

- We came off of overbought levels yesterday, and are beginning to see a steady increase in trading off of recent low-level volume.

- We are breaking below the lows (1291) from last month as well.

- The SPY chart shows a well defined bearish island reversal over this past week, that does a great job in predicting new downturns.

- 30-minute chart has a newly formed double top in place.

- Nearest level of resistance for the S&P is at 1334 and 1340 and then again at 1357.

- Watch for additional support at 1275.

- VIX is still elevated and rests above 24

- S&P is trading below the 10-day, 20-day and 50-day moving averages.

My Opinions & Trades:

- Careful with adding new positions to the market today on both sides.

- Likely to cover my short positions on such a huge move early on.

- Covered WCRX at $19.02 from $20.15 for a 5.6% gain.

- Covered CPWR at $9.00 from $9.03 for a 0.3% gain.

- Shorted KMI yesterday at $33.38.

- Remain short CNH at $39.85 and KMX at $28.13.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.