Pre-market update (updated 8:30am eastern):

- European markets are trading in mixed/flat fashion.

- Asian markets traded 0.8% higher.

- US futures are trading flat ahead of the bell. .

Economic reports due out (all times are eastern): FOMC Meeting starts, ICSC-Goldman Store Sales (7:45am), Personal Income and Outlays (8:30am), Employment Cost Index (8:30am), Redbook (8:55am), S&P Case-Shiller HPI (9am), Chicago PMI (9:45am), Consumer Confidence (10am), State Street Investor Confidence Index (10am), Farm Prices (10am)

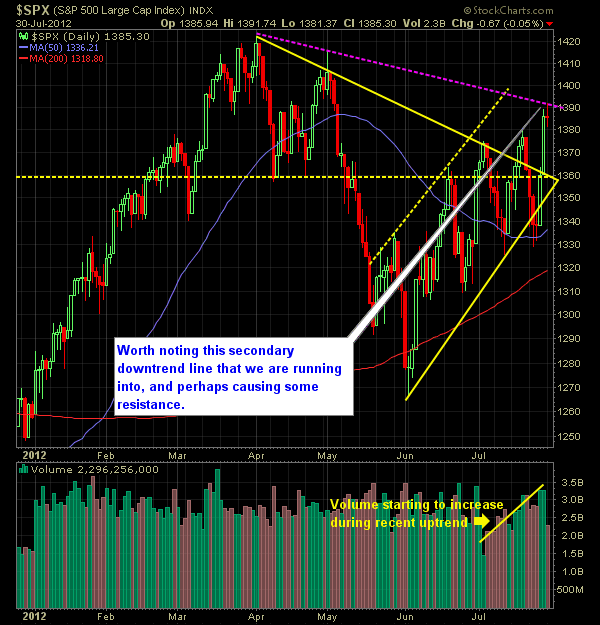

Technical Outlook (SPX):

- After an incredible 2-day rally last week, yesterday saw the SPX unable to advance further, and consequently form a shooting start at the top of its recent higher-high.

- The SPX is now slightly in overbought territory in the short-term.

- Yesterday was met with decidedly lower volume than what we’ve seen lately.

- This week is filled with news movers to be cautious of and will like lead to another light day of trading today as well, since FOMC Statement comes out tomorrow as well as Employment numbers on Friday.

- Despite the market being flat yesterday, the VIX spike over 8% higher, which should be noted, and of some concern for the bulls.

- We could seem some window dressing today, as it is the last trading day of the month.

- SPX has rallied a 48 points in 3 days which is extremely atypical. Don’t be surprised to see some profit taking here over the next day or two.

- Resistance barriers have, including the down-trend off of the 4/2 highs, been broken on Friday. There aren’t any major resistance barriers in the near term for the SPX to face. Minor resistance lies around 1402-6.

- Previous uptrend is now flattened out some, now that we have managed to create another higher-high. Current uptrend support lies at 1337.

- If another sell-off were to ensue, watch for a break and close below 1329 for a new lower-low in the market.

- At this point, the goal for the bulls has to be to continue to trade higher and challenge the 1422 highs from 4/2 which are now well within reach.

- Double bottom recently formed in SPX 30-min chart has been confirmed.

- Solid support formed at the 50-day moving average.

- Of concern is the bearish crossover signal found in this week’s SharePlanner Reversal Indicator. Caution is warranted.

My Opinions & Trades:

- Will look to add additional shorts if we push into the red today, particularly if we break yesterday’s lows.

- Will let my current long stops play out.

- Increased my stop-loss in HES to $47.50 locking in roughly $2/share in gains.

- Shorted FB yesterday at $23.16

- Covered (day-trade) SWHC at $10.19 from 10.03 yesterday for a -1.6% loss.

- Remain long HES $45.60, WTW at $51.10, MDT at $38.15

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.