Economic Reports Due out (Times are EST): Housing Starts (8:30am), Jobless Claims (8:30am), Producer Price Index (8:30am), Bernanke Speaks (9am), Bloomberg Consumer Comfort Index (9:45am), Philadelphia Fed Survey (10am), EIA Natural Gas Report (10:30am)

Premarket Update (Updated 6:30am eastern):

- US Futures are seeing moderate weakness ahead of the bell.

- Asian markets closed -0.3% lower.

- European markets are trading down about -1%.

Technical Outlook (S&P):

- To put the year in perspective for the bears, today’s 7.3 point sell-off in the S&P was the 3rd worse decline of the year. For the Dow, it was the worse day of the year, and almost the first triple-digit loss of the year and we did open up at new highs and failed to keep them.

- S&P saw price drop and close below the 10-day moving average. The 20-day moving average is around 1333.

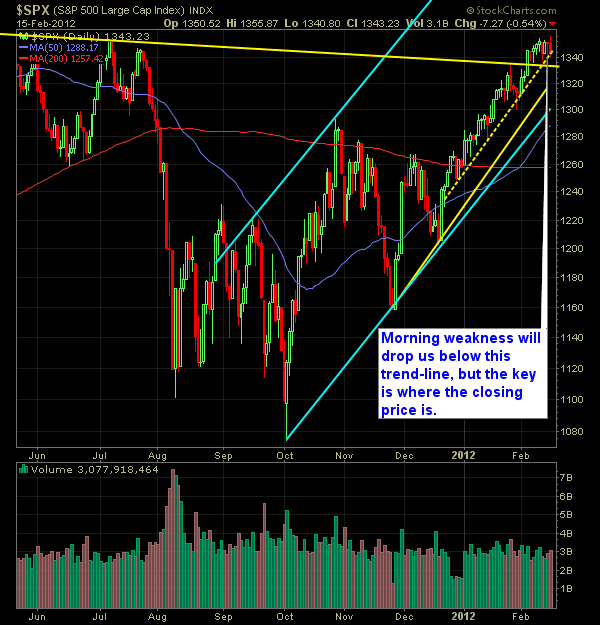

- Early morning weakness, would open the market below its near-term trend-line.

- Slight increase in volume over the past few days.

- The problem with Apple (AAPL) price action yesterday, should it continue, could bring heavy selling pressures to the broader market, considering it has become the bullish poster-child for the market.

- 1351 on the S&P has been a huge price barrior. Breaking it, as we should see a new leg higher in the market.

- Nasty bearish engulfing pattern on the SPY.

- Price level support lies at 1326 and then again at 1300. A break of the latter in coming days would drastically change market behavior/outlook.

- 30-min chart continues to mirror a distribution pattern.

- The SharePlanner Reversal Indicator finally gave us a reversal signal both on the daily and weekly indicators.

My Opinions:

- Particularly if AAPL continues to drop, I expect that the market will face further weakness today and in the coming days.

- VIX is back above 20 (21.14) and that tends make bulls uneasy.

- Rumors continue to drive market hype intraday, don’t be surprised by anything that you see.

- The market seems like it needs to go down some before it can legitimately make another significant move higher. A nice shakeout of bulls from their current positions would go a long ways into forming the next leg up in the market.

- While recognizing a lot of head winds facing the market from an economic standpoint, the market seems to be pricing everything that we know and expect about the European crisis, and with a solid earnings season as well as easing by the Fed, we could see continued price appreciation this year (particularly with an incumbent President up for re-election).

- The daily price action, beyond the obvious ‘buy-the-dip” action has been to breakout and move higher, followed by a few days of consolidation and slight pullback. Rinse and repeat.

- Though we saw the market unable to buy-the-dip yesterday, one day doesn’t mean much – Each time we open where weakness is present, the bulls buy the open, no matter what, and recovers most if not all of the day’s losses. As long as this persists, the bears do not stand a chance, and the bull rally will prevail.

Chart:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.