Technical Outlook:

- Another extremely boring trading session on the S&P 500 (SPX) yesterday. Weakness prevailed the entire day until the last 1.5 hours of trading that saw the market rally off of the lows to minimize the day’s losses.

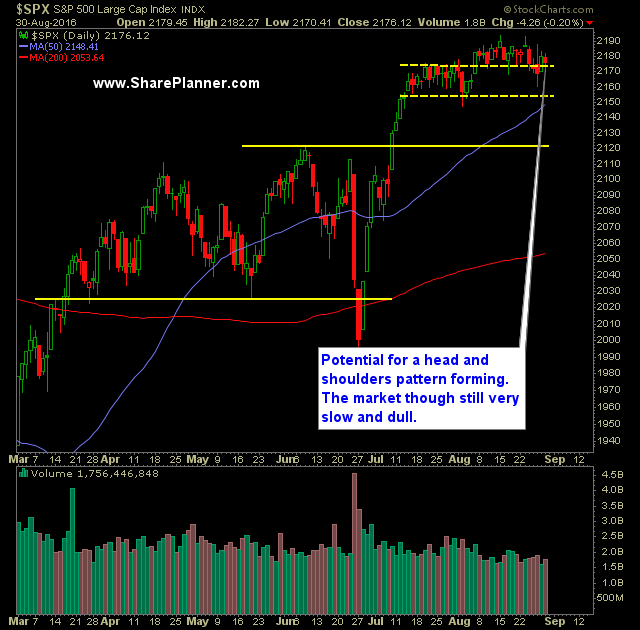

- There is actually a developing head and shoulders pattern on SPX. With as flat as the market has been of late, it doesn’t jump right out at you, at first, but over the last two months of trading there is a left shoulders and head that has formed, and price is now currently forming a right shoulder.

- SPX managed to trade back below the daily middle band and 20-day moving average yesterday.

- On the 30 minute chart, the is a potential higher-low forming coupled with lower-highs. This creates indecision for the market. However, if you drill down to the 5 minute chart there is the potential for an inverse head and shoulders pattern that has formed over the last four trading sessions.

- Volume on SPDRs S&P 500 (SPY) was extremely weak yesterday, and fell for a second consecutive trading session. We are back at the low summer levels experienced throughout this month.

- CBOE Market Volatility Index (VIX) had a rather uneventful trading session, and still struggling with a break out of its current base.

- Since 1928, only 6 months have had a tighter trading range then what has been seen here in August according to LPL Research.

- United States Oil Fund (USO) continues to fade and showing signs of wanting to test the lows from August again.

- USD/JPY continues its rally via BoJ intervention. Up another 0.4% this morning.

- Stocks are continuing to lose momentum under the surface despite the market within points of its all-time highs. This can be most clearly seen by looking at the percentage of stocks trading above their 40-day moving average. Since July 18th, that number has dropped from 80% down to 57%.

- The market consolidated in a similar manner this time last year before ultimately leading to a large sell-off.

- The market is showing a decoupling from oil as the rise and fall of the commodity in June, July and now August has not impacted the market substantially.

- Three support levels to watch going forward on SPX is 2168, 2155, and 2147. The breaks are only valid if the price can close below those support levels.

- Dow Jones Industrial Average (DJIA) has a double top that confirms on a move below 18247.

My Trades:

- Added one new long position to the portfolio yesterday.

- Added one new short position to the portfolio yesterday.

- Did not close out any trades in the portfolio yesterday.

- May add 1-2 new swing-trades to the portfolio today.

- Will consider adding additional short positions to the portfolio as the market warrants it.

- Currently 20% Long / 40% Short / 40% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone