Pre-market update:

- Asian markets traded 1.4% higher.

- European markets are trading 0.1% lower.

- US futures are trading mixed/flat ahead of the opening bell.

Economic reports due out (all times are eastern): MBA Purchase Applications (7), ICSC Goldman Store Sales (7:45), Gallup US Job Creation Index (8:30), International Trade (8:30), Redbook (8:55), Quarterly Services Survey (10), Beige Book (2pm)

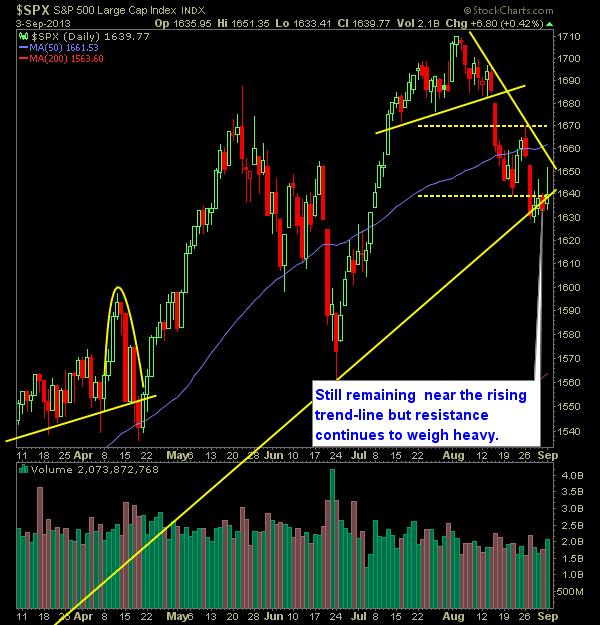

Technical Outlook (SPX):

- Another push higher, another intraday-sell-off that follows.

- What is most disturbing about the SPX at the moment is the glaring bear flag that has formed over the last four trading sessions as well as the resistance at 1640.

- Also problematic is the break of the rising trend-line off of the November 2012 lows. The bear flag that I mentioned is forming on the underside of that trend-lie, as price cannot seem to get back above it again.

- Today that rising support sits at 1641.

- Volume was strong yet again on the first day of trading for September.

- SPX currently down 3 out of the last 4 weeks. That also happened in June 2012 as well.

- 10-day moving average has offered heavy resistance for the markets – three times out of the last five days of trading has failed to break through the resistance. Today the Moving average is 1644.

- SPX remains in oversold territory and its longest tenure of such since November 2012.

- VIX back into the 16’s.

- A number of market meltdowns lately in the final hour of trading – always be prepared.

- I still maintain that the best strategy for this market is to continue trading to the long side in this market. Sell-offs in this environment are quick and hard to capitalize on – better off holding on to the long side and buying on the dips.

- Markets don’t care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Sold CMI at 124.31 for a 0.7% gain.

- Added one additional position yesterday.

- Currently 80% long / 20% cash.

- Current Longs: URS at 49.85, BMRN at 64.50, WYNN at 139.08, DE at 84.75, VIAB at 79.25, and YHOO at 27.15, BA at 104.52

- Market action will dictate today involvement. Sitting on hands until the conditions are right.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.