Technical Outlook:

- Attempted bounce early on yesterday eventually resulted in a sell-off in the afternoon that saw SPX finish lower for the fifth time in the last six trading sessions.

- A late day rally attempt yesterday fell apart.

- Yesterday marked the first time since 3/24 that SPX sold off three straight days.

- Volume on SPY has weakened for a third straight day, and was well below recent averages.

- VIX continues to struggle with the 16.40 level, but it isn’t selling off hard either, which leads me to believe that it will eventually break through that level soon. Yesterday was the fifth straight day it was unable to do so.

- T2108 (% of stocks trading above their 40-day moving average) continues to melt away dropping 4% down to 59% – the lowest such reading since 2/25/16.

- Non Farm Payrolls came in weaker than expected (160k vs. 203k expected).

- A drop below 2033 today on the SPX 30 minute chart would create a significant lower-low for the chart.

- Below 2044 and the market is back in the red for the year.

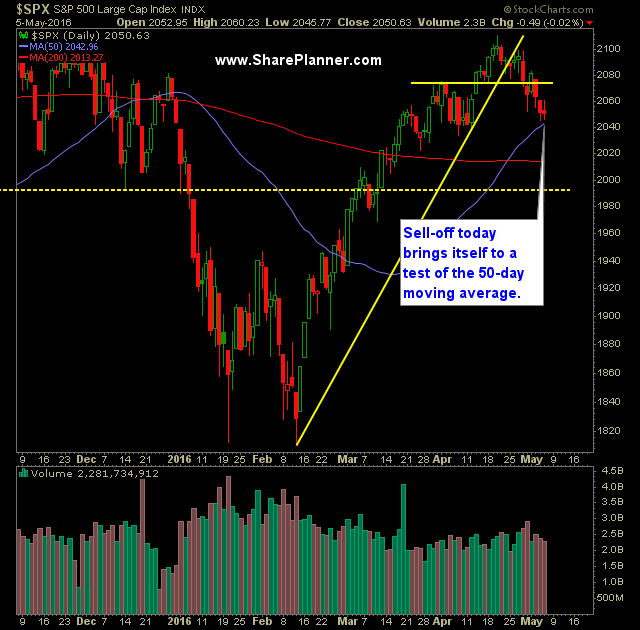

- 50-day moving average to be tested today at around 2042-44.

- A massive breakdown would lead to a test of the 200-day moving average at 2013.

- As always the bears don’t do the best of jobs of holding down weakness on a gap down day. With heavy weakness into the open, look for the bulls to attempt to buy the dip at some point, whether they pull it off or not will be key to the day.

- The objective for the bulls here should be to get price back over 2065, which is where the market closed last week. In doing so it would create a favorable doji pattern heading into next week.

- The bears should be attempting close below at least 2040.

- Historically the May through October time frame is much weaker than the rest of the year.

My Trades:

- Added three new positions to the portfolio yesterday.

- Closed out one swing trade yesterday.

- Currently 40% Short / 10% Long / 50% Cash

- Remain Long: SDS at $18.69 (ETF Short)

- Remain Short: ORCL at $39.74

- Will look to add 1-2 new short positions today if the market seeks to push lower. Will be aware for the potential of a bounce as well.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.