Pre-market update:

- Asian markets traded 0.4% higher.

- European markets are trading 1.1% lower.

- US futures are trading 0.4% lower ahead of the market open.

Economic reports due out (all times are eastern): Jobless Claims (8:30), JOLTS (10), EIA Petroleum Status Report (11), Janet Yellen Speaks (12:45), Treasury Budget (2)

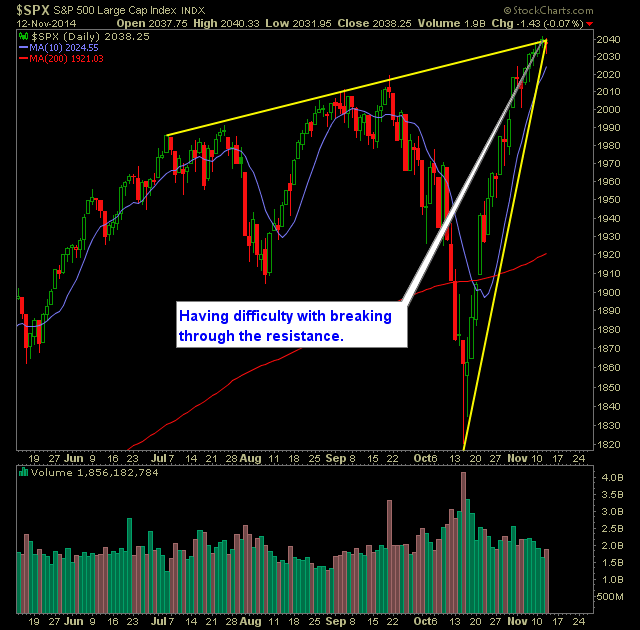

Technical Outlook (SPX):

- Yesterday marked the first down day in six trading sessions.

- Despite the selling early on, dip buyers came out in force and managed to maintain the 5-day moving average for yet another day.

- Volume was a bit higher than what we have seen of late, but still below average.

- VIX rose 0.8% to 13.02.

- SPX 30 minute chart continues to show consolidation over the last 3 days.

- There is a bearish wedge, a rather big one too, that has formed on SPX. Any decent amount of weakness will confirm this pattern.

- Much of the reason for the bearish wedge is the fact that since 1820 SPX has rallied without the slightest of pullbacks and avoiding any kind of higher-low on the chart.

- A confirmed bearish wedge will likely just provide that higher-low and nothing more.

- This market rally is very similar to the July 2013 rally. Like that rally, we are currently in the later stages where the gains become more “stair-stepped”.

- Whether the rally continues for the foreseeable future or not, one thing remains, and that is it cannot continue for much longer, to rally at the gravity defying slope it has done for over three weeks now.

- As a result, consolidation will have to kick in, in order that the trend-line may flatten out some.

- Historically trend-lines that are steeper/greater than 45 degrees are nearly impossible to maintain over an extended period of time.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Closed out PHM at $20.70 for a 7.0% gain.

- Closed out XLE at $86.46 for a 1.7% loss.

- Added two additional long position yesterday.

- Will consider adding 1-2 new long positions today.

- Remain long MS at 34.40, CAR at $56.57, HUN at 24.73, MAR at 76.11, NFLX at 388.71

- 70% long / 30% cash.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.