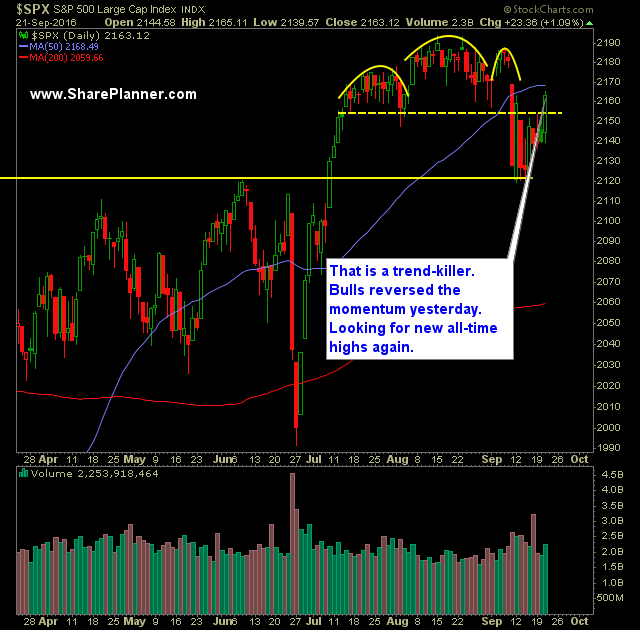

Technical Outlook:

- SPX (SPX) rallied big yesterday as a result of the Federal Reserve deciding to hold off on any interest rate hike until after the election.

- Bank of Japan had minimal effect, but it was thew Fed’s “we should hike, but won’t” policy comments that really goosed the market.

- SPX rallied to near the 50-day moving average, but failed to break through or even test it at this point. This morning, it is looking at a gap above it.

- Resistance had been in the area of 2155 to 2170. That area should be eclipsed this morning.

- At this point, the market is bent on re-testing the all-time highs, if not going right past them. The Nasdaq actually established new all-time highs yesterday.

- 20-day moving average was also tested yesterday, and SPX broke through it.

- Oil (CL/F) continues to rally strong over the course of the last two days and looks to do the same again today.

- SPDRs S&P 500 (SPY) saw its volume increase as well as trade above recent averages.

- Most impressive yesterday was the absolute meltdown in the VIX taking it down 16.5% to 13.3. A massive change from where it was just a couple of weeks ago.

- T2108 (% of stocks trading above their 40-day moving average) saw a large bump higher – rising 39% to 45.54.

My Trades:

- Added one new long position to the portfolio yesterday.

- Closed SPXU at 23.47 for a 3.1% loss.

- Closed QID at 24.51 for a 1.4% loss.

- May add 1-2 new swing-trades to the portfolio today.

- Currently 20% Long / 10% Short / 70% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.