Technical Outlook:

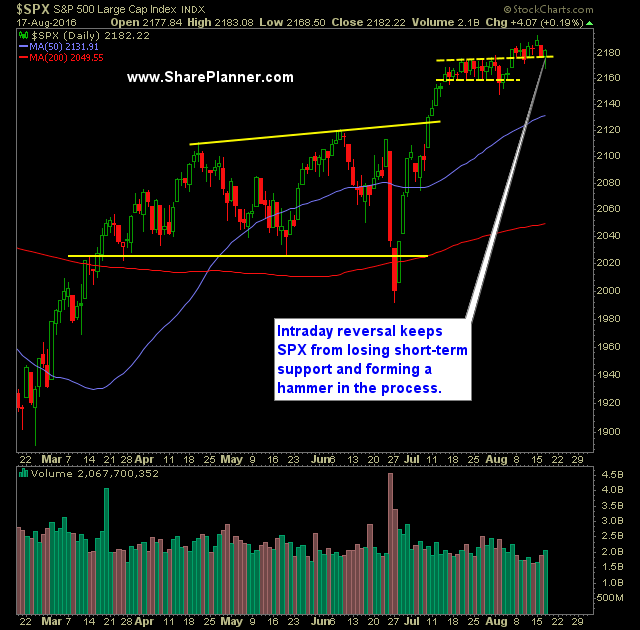

- S&P 500 (SPX) sold off hard and early yesterday, only to see a strong rally, just prior to the FOMC minutes being released, that lasted into the closing bell.

- Despite the rally, the Russell 200 (RUT) was lower and weighed heavily on a large number of stocks yesterday.

- The 20-day moving average was broken intraday, but the bulls managed to still close above it with a solid hammer candle. Also the 10-day moving average was held on to.

- Strong possibility, if the market manages to rally today, that it forms a morning star pattern.

- Yesterday marked nine straight days of alternating up/down on SPDRs S&P 500 (SPY). We are getting close to a record and is the third time in the past year we have been on one of these streaks, which in and of itself is unusual.

- Notable pick up in volume on SPY yesterday vs anything seen over the previous three trading sessions. Nonetheless, still below recent averages.

- VIX was crushed yesterday as well, having risen almost to 14, only to drop 3.6% on the day and close at 12.19. It was unable to push through and sustain a move above resistance at 13.

- Oil continues to climb higher, but the market, just like during its recent downturn, refuses to follow. Over the last three months there has been a notable disconnect between equities and the price of crude.

- Two gaps on the SPY 30 minute chart remains unfilled. Otherwise the price is extremely choppy.

- Key support today will be 2171 followed by 2155. Even a break of the former should require traders to reduce their expectations for the market going forward.

- SPX has not seen a +/- 1% move in either direction since July 8, 2016. Since then the market has moved higher but in very small increments and tight daily ranges.

- Dow Jones Industrial Average (DJIA) is keeping the double top pattern in play here. However it is coiling just underneath resistance which leads me to believe it wants to break through.

- The bulk of the earnings season is behind us. No significant disasters from the big names that reported that negatively impacted the market as a whole.

- Overall, August is the worst performing month for the Dow and S&P 500.

- At this point, and with the election ahead, I’d expect the market to keep rallying higher. I don’t expect there to be a rate hike between now and the election. To do so would impact the market and thereby the election. I don’t think the Fed wants that, particularly since Trump has indicated that he would replace Yellen.

My Trades:

- Added 3 new long positions yesterday.

- Sold ADBE yesterday at $99.69 for a 0.7% profit.

- Sold KMX yesterday at $58.60 for a 1.1% loss.

- Sold PHM yesterday at 29.97 for a 2.6% loss.

- May add 1-2 new swing-trades to the portfolio today.

- Will consider adding additional short positions to the portfolio as the market warrants it.

- Currently 60% Long / 10% Short / 30% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.