Pre-market update:

- Asian markets traded 0.8% lower.

- European markets are trading 0.3% lower.

- US futures are trading 0.4% higher ahead of the market open.

Economic reports due out (all times are eastern): Jobless Claims (8:30), Retail Sales (8:30), Import and Export Prices (8:30), Business Inventories (10), EIA Natural Gas Report (10:30)

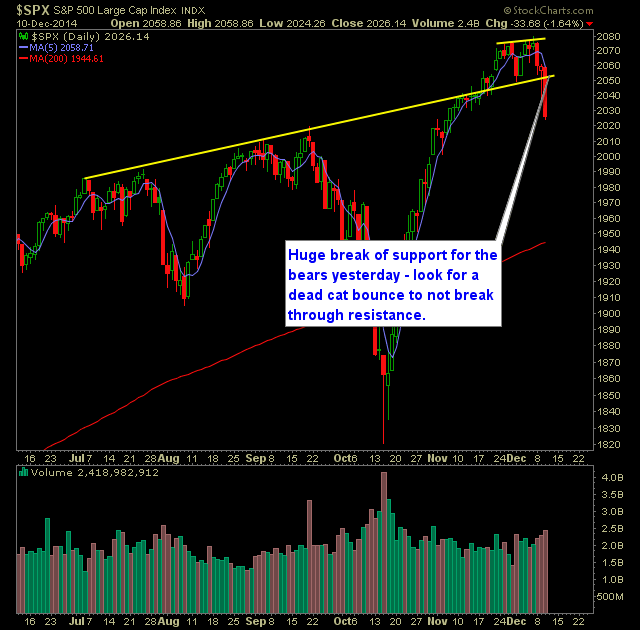

Technical Outlook (SPX):

- Huge sell-off yesterday that hasn’t been seen since the pullback in early October.

- SPX sliced through the 20-day moving average yesterday.

- The two support levels I mentioned in yesterday’s trading plan, 2050 and 2030, were both broken yesterday.

- This adds a drastic bearish element to the market going forward. Any rally going forward should be considered a dead cat bounce unless proven otherwise.

- VIX rose an eye-opening 24.5% yesterday to 18.53. Highest level since October.

- Double top on 30-minute SPX chart was confirmed yesterday.

- Volume was well above average yesterday.

- I wouldn’t look for the dead cat bounce to go much above 2051.

- Yesterday’s move was a very rare move in that it is much more inclined to rally after a huge rally off of the lows the day prior. Bears defied the favorable, bullish odds.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Added 2 new short positions today.

- Stopped out of IBM at 160.95 for a 1.8% loss.

- Stopped out of BABA at 103.88 for a 3% loss.

- Will consider adding 1-2 new positions today.

- Remain long GLW at 21.20, EBAY at 55.31, AAPL at 112.74.

- 30% long / 20% Short / 50% cash.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.