Pre-market update:

- Asian markets traded 0.3% lower.

- European markets are trading 0.2% lower.

- US futures are trading 0.2% higher.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Consumer Price Index (8:30), Redbook (8:30), Treasury International Capital (9), Housing Market Index (10)

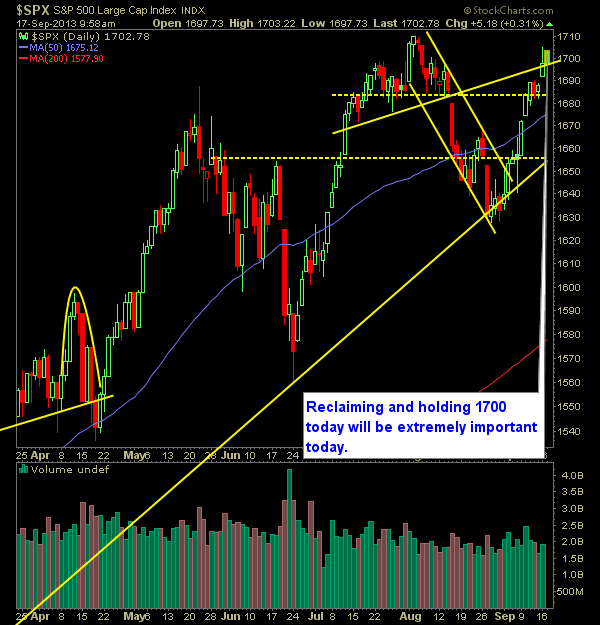

Technical Outlook (SPX):

- Huge open yesterday lost nearly all of its daily gains. It is imperative for the SPX to recapture a chunk of those today.

- Ideally SPX needs to reclaim 1700 – if it does that, I will feel better about yesterday and progress going forward.

- Short-term resistance at 1699-1700 that needs to be cleared. After that, its just the all-time highs that will offer the SPX any resistance.

- Watch the 10-day moving average going forward as a nice trend-line for determining rising support in this market.

- Saw a nice uptick in volume yesterday.

- SPX is far and away from any near term support in the market. 1657 is the nearest level of support.

- I am continuing to trade to the long side, and for the foreseeable future.

- Syria is becoming less of a threat for for the markets, particularly now that is seems improbable the United States with stage an attack on the country.

- SPX back firmly in overbought status short-term.

- Markets don’t care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Sold URS yesterday at 54.05 for a 6.7% gain.

- Sold PKG at $58.00 for a 6.6% gain.

- Currently 60% long / 40% cash.

- Current Longs: SLB at 82.34, JCI at 41.66, OSK at 46.91, EXXI at 27.54, FTNT at 20.63, SPWR at 23.51.

- Will look to add 1-2 additional positions to the portfolio today.

- Must wait until after the first hour of trading to gauge the strength of the gap up.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Which trading platform in 2026 should you be using? In this podcast episode Ryan talks about all the major platforms out there from TC2000 to TradingView, to TrendSpider and the Bloomberg Terminal. What are the perks and benefits to each one, and Ryan will also go over his lower-tier platforms that you might want to consider as well.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.