Pre-market update (updated 9am eastern):

- European markets are trading 0.4% higher.

- Asian markets traded 1.0% higher.

- US futures are moderately higher ahead of the bell.

Economic reports due out (all times are eastern): No news

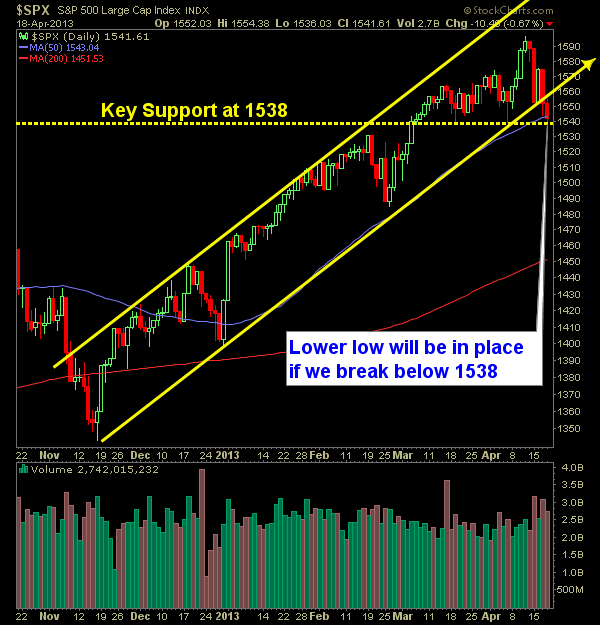

Technical Outlook (SPX):

- We sold off yesterday for the fourth time in the last five days.

- We broke below the 50-day moving average yesterday for the first time since 12/28/12.

- More importantly we broke the long-term channel that we had been trading in since the November 2011 lows.

- Even more interestingly, we tested the lower Bollinger band yesterday and bounced, after having outside the upper band just 5 days earlier.

- 1538 is the KEY level for me today. We break 1538 and there is no support until we get under 1500.

- Today’s gap higher is nothing to get excited about from a bullish perspective, particularly since we have dropped off of the highs quite a bit.

- The dip buying has been non-existent of late.

- VIX continues to trend higher, now above 17.

- Markets don’t care about the economy. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

- Both channels (July October 2012) and the price channel we are currently in are very similar in nature.

- We haven’t seen a market pullback in excess of 4% since October/November time-frame.

My Opinions & Trades:

- Added DISH yesterday at $38.10.

- Sold WTW at $40.67.

- Remain Long BWLD at $87.95, DISCK at $71.12, TRLA at $33.07, TSCO at $105.55.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.