![]() Technical Outlook:

Technical Outlook:

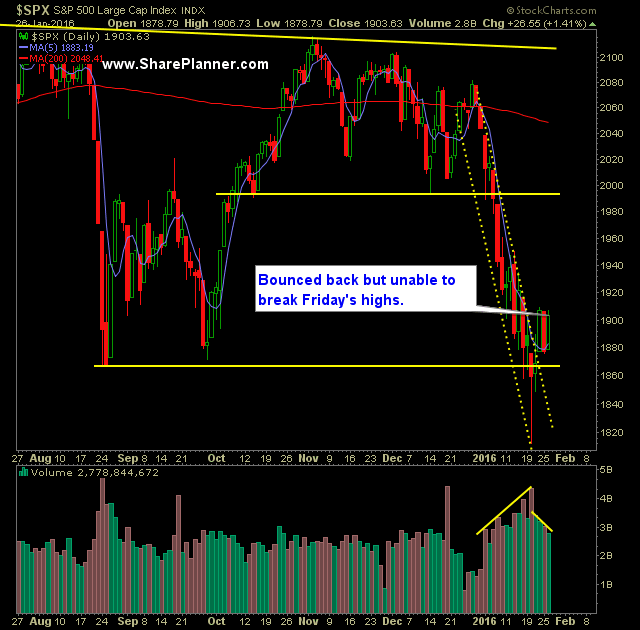

- SPX bounced back from Monday’s decline creating a 3-day period of choppiness for the market as it is trying to digest recent gains. With futures pointing downward, there is the possibility of continued choppiness today.

- FOMC Statement comes out today and will spur on additional volatility. I expect that FOMC will play this non-press conference statement very safe and even try to give the bulls a kicker to avoid additional selling pressures in the broader market.

- Volume continues to fall on SPY over the course of the past week following last Wednesday’s market bottom, despite the fact that volume was slightly higher than the day prior.

- So far this bounce off of the lows have been extremely sluggish. Intraday bounces continues to see euphoria wear off during afternoon trading.

- Prior bounces have seen massive 2-3% bounces each day on multiple days. So far this has not been the case.

- SPX recaptured the 5 and 10-day moving averages and the former is actually starting to slope higher, while the latter is on the verge of doing so. Both positive developments for the bulls.

- It still seems likely that the market will see a bounce into the 1950-2000 area before ultimately falling again.

- VIX dropped 6.8% yesterday and settled at 22.50 but still somewhat elevated.

- Very strong bounce in T2108 (% of stocks trading above the 40-day moving average). It rose 41% to 15.81, but still very, very oversold.

- Still a inverse head and shoulders pattern on the 30 minute chart of SPY, and some heavy resistance it needs to break through based on the post I did yesterday afternoon.

- I still don’t think we have seen a major short squeeze out of this market yet and it remains a possibility for the bulls to try and exploit here.

- There are still a number of significant earnings reports this week including Facebook (FB) Microsoft (MSFT) and Amazon (AMZN) not to mention a FOMC Statement tomorrow and GDP on Friday. So there are a lot of headline risks taking place both during and after market hours.

- The only time we have really seen significant short squeezing from the market was Wednesday afternoon. Either the bears think they can ride this rally out, or the shorts are going to be forced to cover at much higher levels than anticipated.

- Confirming the head and shoulders pattern on the weekly chart of SPX/SPY will be critical for the bears if they are going to keep the downtrend going.

My Trades:

- Closed HRS yesterday at $85.45 for a 1.1% gain.

- Covered IWM yesterday at $100.56 for a 0.3% loss.

- Added two new swing trades to the portfolio yesterday.

- Currently 20% long, 80% Cash

- Very difficult market to navigate this week. Major earnings reports including AAPL, AMZN, FB as well as FOMC Statement and GDP. Lighter is better here.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.