Pre-market update:

- Asian markets traded 1.1% lower.

- European markets are trading 1.4% lower.

- US futures are trading 1.3% lower ahead of the market open.

Economic reports due out (all times are eastern): MBA Purchase Applications (7), Retail Sales (8:30), Import and Export Prices (8:30), Business Inventories (10), EIA petroleum Status Report (10:30), Beige Book (2)

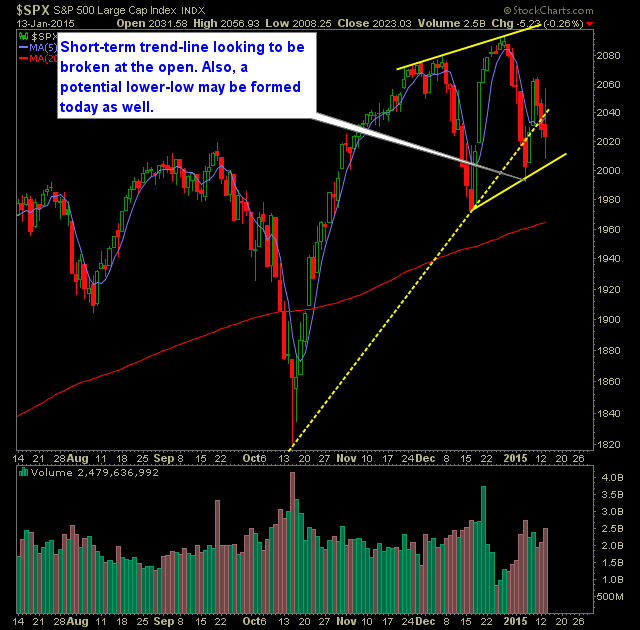

Technical Outlook (SPX):

- Wild day of trading in the market yesterday that saw more than 26 points on SPX get sold off, to finish the day in the red.

- A break below 1992 would create a new lower-low for the market and likely make a push to challenge the December lows.

- SPX poised to open the day below 2000.

- Volume was very strong with yesterday’s selling.

- Crude continues to slide, despite yesterday’s modest rally.

- VIX rose 4.9% to 20.56 yesterday.

- SPX 30 minute chart is looking to confirm a dilapidated head and shoulders pattern that can also be seen on the daily chart as well.

- Be aware, that even in the most bearish of trading environments, the Fed or ECB or any centralized bank manages to say or do something that sparks an end to the selling. Always be prepared and aggressively book gains on short positions.

- By breaking the 1/7 lows, SPX would create a lower-low and lower-high.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Covered NTAP yesterday at 39.34 for a 1.1% gain.

- Sold CIEN at 19.18 yesterday at 19.18 for a 1.3% loss.

- Sold MAR yesterday at 77.59 for a 2.3% loss.

- Added two new short positions yesterday.

- Will consider adding 1-2 new positions today.

- 30% Short / 70% cash.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.