Technical Outlook:

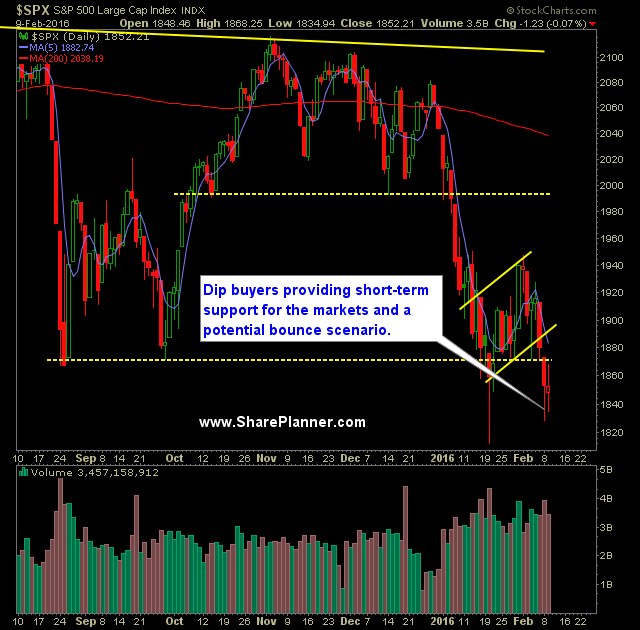

- Choppy trading session yesterday that saw the market gap lower but spend the rest of the day chopping around and ultimately recovering the day’s losses.

- Futures have rallied strong overnight as European markets stage a strong rally.

- Yellen’s testimony before congress is expected to weigh large on the markets prior to equities opening and dictating the market’s direction throughout.

- Once again, the massive head and shoulders on the weekly chart of SPX/SPY provided support for the market yesterday and the price point that it rallied from. This will be in play yet again today. If this confirms, the target on the pattern suggests an eventual 200-300 point move to the downside.

- Volume was slightly less than the day prior on SPY, but still above average.

- While we may be seeing a short-term reprieve from the market, overall, the it remains very bearish, and bounces should be treated as a ‘dead cat’ unless proven otherwise.

- VIX still managed to rise 2% yesterday to finish the day at 26.54. Declining resistance is there off of the August highs, and could see provide resistance in the short-term.

- T2108 (% of stocks trading above the 40-day moving average) dropped 6.4% down to 20.79. Despite SPX right near recent lows, T2108 is significantly off of its lows and may be signaling a bullish divergence.

- Potential double bottom play on the 30 minute chart of SPX. Bears will need to push this through the 1812 level quickly or risk the bulls rallying the market in the short-term.

- Insane price movements every day being created by computer generated trading (HFT’s) in a highly volatile market marked with enormous headline risk.

- There is a lot of stop-loss hunting out there in the market, and being agile with getting in and out of positions quickly has been extremely important.

My Trades:

- Covered ORCL at $35.20 for a 1.1% gain.

- Covered DIA at $160.36 for a 0.4% loss.

- Did not add any new swing-trade positions to the portfolio.

- Currently 100% Cash

- Market is starting to weaken significantly again, and looking to add 1-2 new short positions today.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.