Technical Outlook:

- Extremely dovish and extremely unexpected FOMC Statement yesterday that cut the yearly outlook of 4 additional rate hikes down to 2 additional rate hikes.

- As a result, Yellen, by cutting the number of rates for the year, essentially gave the market the equivalent of two rate cuts yesterday.

- Be careful today, because a lot of the central banking actions of late, including the recent Draghi decision has resulted in next day reversals.

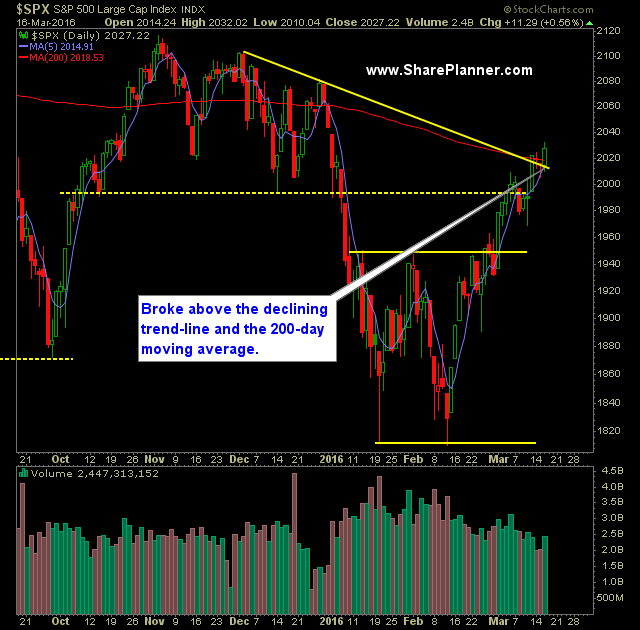

- 200-day moving average was broken yesterday, and the down trend off of the December highs was broken too.

- Bascially SPX is now trading above all the major moving averages.

- SPY volume picked up for the second straight day, but even with a FOMC announcement, was still below recent averages.

- VIX saw a major move yesterday that resulted in the VIX dropping below the rising trend-line off of the October lows, dropping a big -11% down to 14.99.

- USO coiling at recent highs popping 5% yesterday.

- Divergence in IWM, as yesterday’s move failed to make new rally highs.

- T2108 at 83.5%rising only 2.8% yesterday.

- SPX looking to close in on breakeven for the year. At 2044 level on SPX, there is a significant amount of resistance that was created during February – August time period of 2015.

My Trades:

- Did not add any new swing-trades yesterday.

- Closed out JPM at $59.12 for a flat trade.

- Closed out SPXS at 16.28 for a 2.5% loss.

- Currently 100% Cash

- Will look to add 1-2 new positions and follow the market’s direction

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, Ryan answers the questions of one listener ranging from his transition from paper trading to live trading, and swing trading to day trading. Also addressed is his approach to trading, specifically Fibonacci retracement levels and why Ryan prefers Pivot Points instead.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.