Technical Analysis:

- Another day for the S&P 500 (SPX) where it manages to close with a doji candle pattern. The market, as has been the case all year long, shows some willingness early on to sell-off, only for the dip buyers to bail it out before the end of the day.

- Volume on SPDRs S&P 500 (SPY) fell for a third consecutive day and below recent average levels.

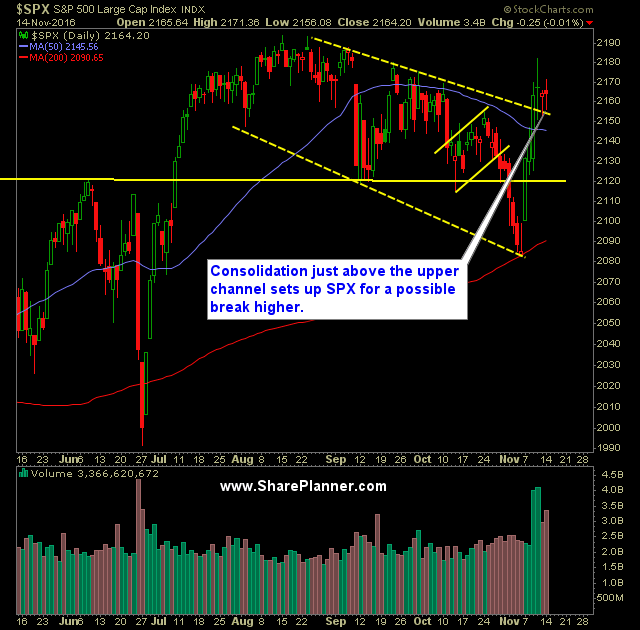

- If SPX breaks out to the upside here following this 3-day holding pattern, the breakout should probably be respected, though I wouldn’t expect a move like what we saw out of it early last week.

- The only issue that remains is the massive move way outside the daily bands on Russell 2000 (IWM) and Dow Jones Industrial (DIA) where price is extremely stretched and overbought.

- Speaking of IWM, the volume there over the last four days has been monumental with massive amounts of buying taking place.

- Don’t chase in this market – it isn’t the time to suddenly decide you want to buy the financials.

- Three straight days of the CBOE Market Volatility Index (VIX) wanting to bounce but getting squashed each time before the market closes. Notice the very large candle shadows above the candle bodies.

- 30 minute chart of SPX shows a healthy triangle pattern that may breakout to the upside today.

- There is a clear rotation taking place in this market where money is flowing from tech and utilities and into defense, banks, and infrastructure.

- Poor breadth continues to dominate this market over the last three trading sessions.

My Trades:

- Did not close out any positions yesterday.

- Added one new position to the portfolio yesterday.

- Will look to add 1-2 new swing-trades to the portfolio today.

- Currently 20% Short / 80% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.