My Swing Trading Strategy

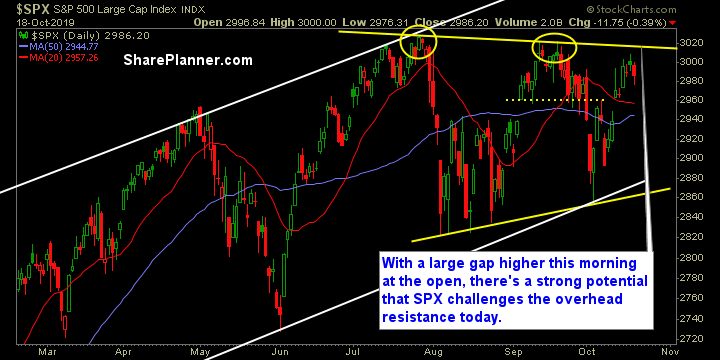

No new trades, I have very little to desire to get heavily long while resistance lurks overhead. Most traders out there do not understand that, and simply assume that the resistance will be broken, and while it attempting to do just that, history has shown that feat to be much harder than it appears. For now, I will patiently wait for that to happen.

Indicators

- Volatility Index (VIX) – An attempt to bounce off of extreme lows, but failed to hold on to most of its gains. It does however, have a very nice base that has formed on the 30- minute chart. I’ll be interested in seeing if it diverges from market strength today.

- T2108 (% of stocks trading above their 40-day moving average): Still a bearish divergence,and like the VIX, I’ll be interested in seeing how much strength this indicator shows at the open.

- Moving averages (SPX): The 5-day moving average broke yesterday for the first time since 10/9. Likely to reclaim it by the open today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology continues to be the weakest sector out there, and this week’s earnings will be key for it going forward. Real Estate still the strongest sector followed by Utilities. Healthcare and Financials have markedly improved as has Industrials, which is also facing a very important week on the earnings front.

My Market Sentiment

Still a very strong, headline driven market, with yet another gap higher. Doji candle patterns have been the norm of late, which means, very little difference from the opening print to the closing print during regular trading hours. Until resistance is broken, the risk is elevated in this market (even though it isn’t being reflected in price) and reward is minimal. Break out, and everything changes.

Current Stock Trading Portfolio Balance

- 1 Short Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.