My Swing Trading Strategy

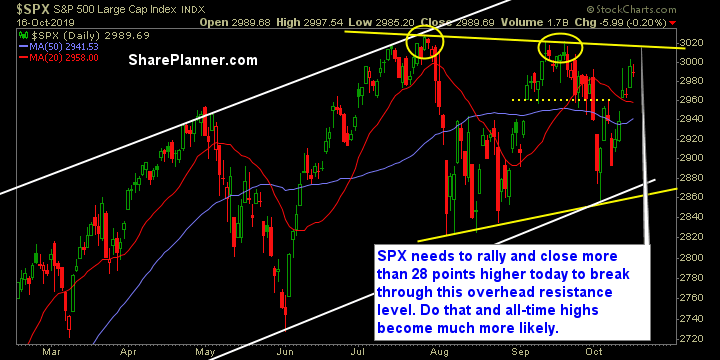

No new trades yesterday. Market was weak, and provided little-to-no trading opportunities. Considering how the market does with resistance overhead, I’ll consider adding a long position to the portfolio. Otherwise, if the market fades quickly following the opening bell, it may be reason to stay put, once again, and or add short exposure, as the market will be signaling its struggles with pushing through its all-time highs.

Indicators

- Volatility Index (VIX) – Market lower yesterday, but (except for Russell), and the VIX only squeezed out a marginal gain of 1%. Still, this is the area of the VIX between 11.5 and 13.50 where the it tends to see its biggest bounces.

- T2108 (% of stocks trading above their 40-day moving average): Breadth held up quite well, actually positive on NYSE, T2108 saw barely any decline. Remains at 54% – barely anything to speak of.

- Moving averages (SPX): Price is currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

While the overall market was down, it was in large part due to weakness in Energy and Technology. Stocks with the software industry are showing the most weakness after yesterday’s big sell-off, and oil continues to give up its daily gains and as a result wreck havoc on energy stocks. Materials has been trading in a tight range over the last three sessions and could see a big break as a result in either direction.

My Market Sentiment

Very close to a break through near term resistance, but the problem for more than a year has been the difficulty of this market to sustain any substantial move near the all-time highs. Brexit news this morning could very well change that, but more than likely that news has probably been largely priced into stocks.

Current Stock Trading Portfolio Balance

- 1 Short Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.