My Swing Trading Strategy

No new positions for me yesterday. Call me crazy, but I’m not going to load up on long positions when there is zero rhyme or reason behind these market gyrations. For Pete’s sake, the market is falling on whether or not the Chinese delegation ordered ham & cheese or just soup and salad during their visit to the White House. I closed out my one short position, for a loss of course, and am sitting comfortably in 100% cash.

Indicators

- Volatility Index (VIX) – Surprisingly enough, it isn’t dropping all that much with these market rallies. Still elevated and at 17.57.

- T2108 (% of stocks trading above their 40-day moving average): A 13% rally taking the indicator back up to 42%, but well off the recent highs.

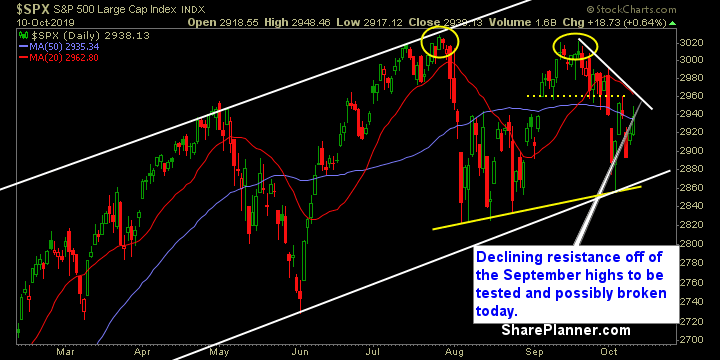

- Moving averages (SPX) Broke back above the 5, 10, and 50-day moving averages. These particular MA’s have come to mean very little in terms of support/resistance, slicing through them at will.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology barely participated in yesterday’s rally which was surprising. Instead it was all about the Materials and Energy leading the way, with the latter being one, I don’t prefer to touch. Despite a hard rally, there was very little interest in buying up Discretionary stocks as companies like Amazon (AMZN) actually finished lower on the day.

My Market Sentiment

The unpredictable nature of this market of late has made for a difficult time for traders. SPX has a shot here of closing out the week higher than where it started, but the 2:45pm EST trade talks between the US and China creates a possible scenario of the market possibly tanking if an agreement can’t be reached.

Current Stock Trading Portfolio Balance

- 100% cash

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.