My Swing Trading Strategy

I took profits in my two-day trade in Twitter (TWTR) for a +1.3% profit. Not a ton (but more now with free commissions of course ?) but considering that the market is looking at a significant gap lower this morning, it confirms my concern with the market going into today. I will be looking to possibly get short early into the trading session.

Indicators

- Volatility Index (VIX) – The 4.8% pop yesterday in the VIX keeps the momentum over the past two weeks in the VIX (to the upside) intact for a move back above 20.

- T2108 (% of stocks trading above their 40-day moving average): More evidence that the recent rally was a dead cat bounce, the T2108 dropped 5.2% yesterday to form a shooting-start like candle (though it is inside the previous candle pattern – you get the point though).

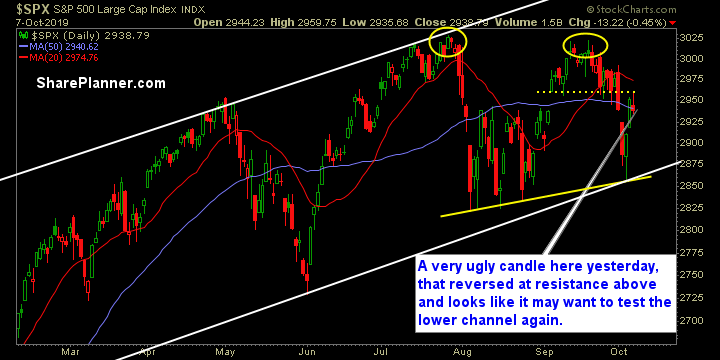

- Moving averages (SPX) After holding it for just a day, price fell back below the 50-day moving average, and likely to test the 5-day MA today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology hasn’t been as weak as some of the other sectors of late, like Energy or Discretionary, though every sector finished lower yesterday. Again, there is little reason to be playing the Energy sector at this point in time, and Financials should be avoided as long as bonds keep their rally up.

My Market Sentiment

Rising channel more than intact for now. However, the retest of the channel could certainly happen again soon should today’s weakness hold through the close. Yesterday’s candle has all the makings of a reversal candle.

Current Stock Trading Portfolio Balance

- 100% cash.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.