My Swing Trading Strategy

Alright, alright, alright. I closed out my position in SPXU, which again is a 3:1 inverse return of SPX, yesterday for a +3.5% profit. Not bad, but I thought I might come away with a little more than I did. Good thing I closed it though because the market is gapping higher, and I would have lost my profits on the trade, if I hadn’t. With that said, hard to gauge which direction I will ultimately be trading. Perhaps it is a gap and crap kinda day, or a gap and run. Hard to say, I will have to watch the price action early on and decide for myself.

Indicators

- Volatility Index (VIX) – Down 4% yesterday, which doesn’t seem like much but well off of its intraday highs of 23.16. Should see some further downside again today with the strength in equities this morning. Needs to ultimately hold 16.82.

- T2108 (% of stocks trading above their 40-day moving average): A 5% rally yesterday and may be ready for a bounce as a likely pop in bond yields today should help goose the market higher today.

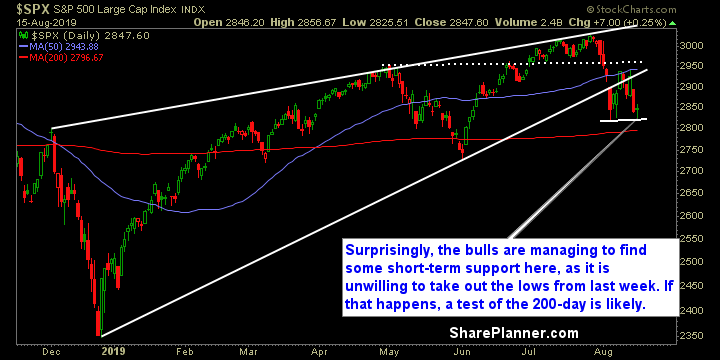

- Moving averages (SPX): Back below the 5 and 10-day moving averages. Setting up well for a test of the 200-day moving average at 2795. Worth noting that the Dow Jones Industrial Average broke its 200-day moving average yesterday. The 5-day and 10-day moving averages could be in play today, and start watching the 150-day MA, as that has been an area that the market continues to consolidate around and bounce from.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The safety stocks like Utilities, Staples, Telecom and Real Estate saw all the market strength yesterday. See the full sector analysis I did by clicking here.

My Market Sentiment

The market is certainly gapping higher this morning, but really lacks a lot of gusto in doing so. The volume doesn’t ‘appear to be there, and a good chance we see the strength fade throughout the day. However, bond yields have been quite depressed these last two weeks, so a bounce there could certainly lift the prices of equities as well. Short-term support over the last two weeks have held strong for the market so keep an eye on that as well.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.