My Swing Trading Strategy

No new positions for me yesterday. I considered shorting the Nasdaq some, but the volume simply wasn’t there in the selling, and I didn’t want to set my self up for a possible short squeeze right from the very start. I currently am shorting the market using a long position in SPXU which provides an inverse return of SPX of 3:1. Right now I am up +4.3% on the trade. Again, being nimble in these market conditions is by far the best approach a trader can take.

Indicators

- Volatility Index (VIX) – Volatility popped yesterday and had one of its better candles of the past month, rising 17.4% to 21.09. That puts the VIX back over 20, which tends to be your traditional Risk-on/Risk-off mark.

- T2108 (% of stocks trading above their 40-day moving average): Not as much of a decline as I would have expected. Down 11.5% yesterday to 33%. Still weak, but would like to see this indicator get flushed out before getting long on this market again.

- Moving averages (SPX): Broke the 5-day moving average again yesterday, which as of yesterday’s close, was actually veering higher. Weakness today, will likely change that today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials were hammered yesterday and the market’s weakest sector, mainly due to the weakness in the 10-year yield. This sector is also heading towards a test of its 200-day moving average which has impressively managed to find support from this MA continuously throughout 2019. If that fails, the sector would sport a marvelous double top pattern. The same can be said about the Industrials as well. And Energy just looks plum awful. Making lower-highs and lower-lows all throughout 2019 so far. All the sectors saw heavy selling yesterday, and many of them are showing some major long-term double topping patterns that could confirm if the market selling continues.

My Market Sentiment

Yesterday’s SPX decline, while an impressive -1.2% to the downside, really lacked the volume that should be accompanying such a sell-off. That makes me question whether the market has the legs to push all that much further to the downside without any kind of real panic from investors and traders trying to get out of their positions in a fury. I saw that last Monday with the incredible sell-off that was seen there, but has been absent ever since.

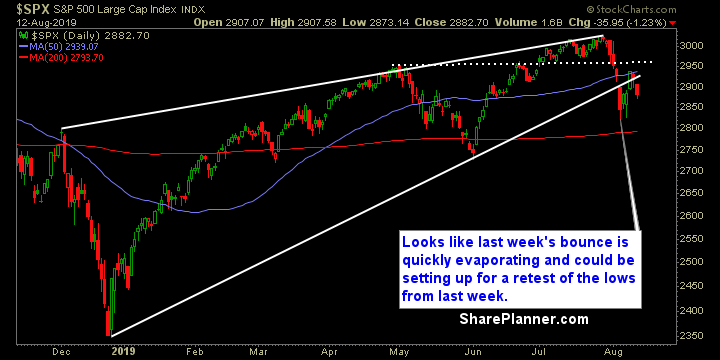

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 short position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.