My Swing Trading Strategy

I did not take any trades yesterday. The large gap up and subsequent gap fill, was tempting to short, but chose not to pounce on it, because I didn’t want to be squeezed by an afternoon rally (which eventually did happen). I am open to adding some long positions to the portfolio today or even shorting it, if this is a momentary visit at the all-time highs.

Indicators

- Volatility Index (VIX) – A very wild day on the VIX indicator, that despite the rally to new all-time highs, the VIX was up 3% on the day. A very unusual occurrence, and something that gave me pause throughout the day.

- T2108 (% of stocks trading above their 40-day moving average): Only a 9.6% rally yesterday. I actually expected more. So while the market aggressively closes at new all-time highs, only 56% of stocks are trading above their 40-day moving average, which is less than the reading we saw in April.

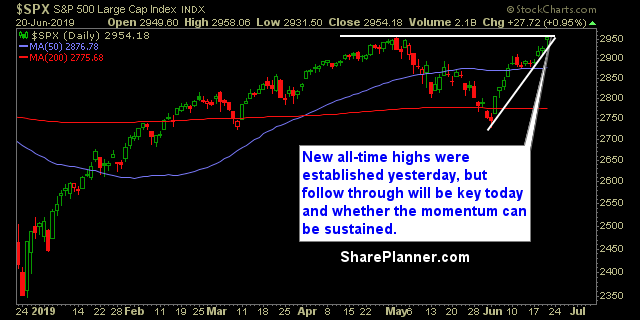

- Moving averages (SPX): SPX currently trading above all of its major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy, as expected, was the day’s big winner and the one sector with the most room to run. However, it has been extremely erratic in its trading behavior of late. Materials also continued its dramatic run off of the June lows. When looking at the sector charts it is only the defensive sectors like Staples, Real Estate, Utilities and Telecom that are printing new all-time highs, while all the growth sectors like Technology, Discretionary and Industrials are well below those all-time highs.

My Market Sentiment

SPX established new all-time highs yesterday along with the Dow Jones Industrial, while the Nasdaq and Russell 2000 remain below theirs. Breadth overall is not impressive, as mentioned above on the indicators, and some warning signs to be considerate of.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Which trading platform in 2026 should you be using? In this podcast episode Ryan talks about all the major platforms out there from TC2000 to TradingView, to TrendSpider and the Bloomberg Terminal. What are the perks and benefits to each one, and Ryan will also go over his lower-tier platforms that you might want to consider as well.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.