My Swing Trading Strategy

I expected to hold on to SPXU yesterday longer than I did, nonetheless, I was forced to quickly act and close out the position for a +1.1% profit. I added another long position yesterday, and will consider one more today if the market can sustain the early market gains.

Indicators

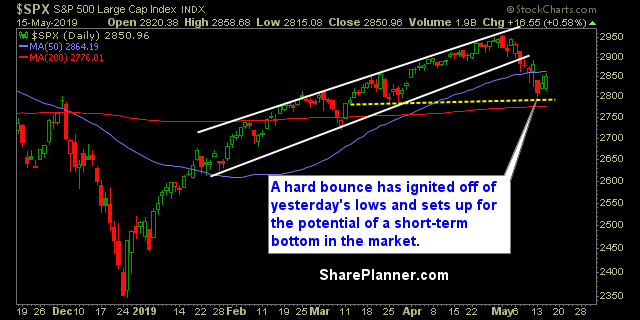

- Volatility Index (VIX) – A drop of 9% sent the VIX down to 16.44 and likely sets up for a break of the lows from last Friday.

- T2108 (% of stocks trading above their 40-day moving average): A small bounce of 6.7%, not as much as you’d expect, but still a positive move off of the lows of the day. Currently sitting at 43%.

- Moving averages (SPX): Broke back above the 5-day moving average (barely), and could see a test of the 10-day MA as well today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the market leader yesterday and was so by a long shot. Money flowed out of Financials and Utilities and back into Tech and Discretionary. Staples now trying to break out of the bull flag it has been in for much of this month. Real Estate holding up well and ready to break out to new all-time highs.

My Market Sentiment

A legitimate bounce attempt has unfolded in the market. A test of the 50-day moving average is likely today. Any bounce should be viewed with suspicion as it is quite simple for the market to reverse direction on a simple market headline in regards to the tariff war between the United States and China.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.