My Swing Trading Strategy

Two new positions were added yesterday, while continuing to hold on to the existing trades. I’ll entertain adding another today, if yesterday’s momentum can be sustained.

Indicators

- Volatility Index (VIX) – Dropped 1.1% down to 12.28, bouncing off the lows in the final hour of trading. I don’t expect big moves to the downside from here.

- T2108 (% of stocks trading above their 40-day moving average): Breadth was the best I have seen in a long time with the day trading a 3:1 edge for advancing issues. On the T2108, a big spike of 13.4% to 64%.

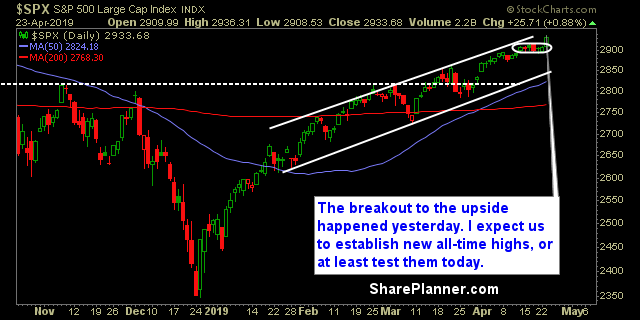

- Moving averages (SPX): Price is trading above all the major moving averages now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Heathcare had a much needed bounce of 1.7% yesterday and helped the rally sustain its gains. Five sectors matched or beat the market yesterday. Technology also soared to new all-time highs as did Discretionary for the first time since the Q4 sell-off. Energy, Materials and Telcom didn’t see any action.

My Market Sentiment

SPX improved its volume levels from the ridiculously low volume levels the day before. Huge breakout of the five-day trading range. Look for a test of the all-time highs today.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.