My Swing Trading Strategy

I added one additional trade to the portfolio, but the market still showing a low volume readout following Monday’s rally. I may add one additional trade to the portfolio today as well, depending on the strength of the market.

Indicators

- Volatility Index (VIX) – Spent all of yesterday trending higher in small increments, with a final gain of 2.8%. Still compressed, but a rally back to the March highs isn’t out of the question.

- T2108 (% of stocks trading above their 40-day moving average): This chart is diverging once again from current price action on SPX. Same thing happened last September with a continuous series of lower-highs despite SPX making higher-highs.

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology remains Mr. Dependable of late, as it is has been at or near the strongest sectors on a near daily basis. Telecom sporting a bull flag pattern breakout, while the Financials are possibly forming the right shoulder of a head and shoulders pattern. Heathcare continues to coil at its highs.

My Market Sentiment

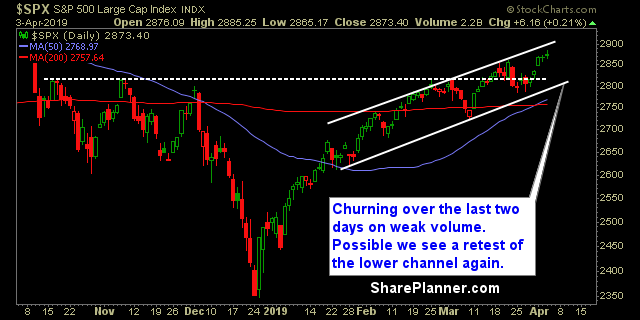

Not as bad as Tuesday’s holiday-like volume reading, but still low again for SPX and the weight of Facebook’s (FB) quick sell-off took the entire SPX down with it. Up five straight days, the potential some profit taking looms in the days ahead. So be prepared should that happen. Right now, the channel shown below continues to dominate the current market behavior.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.