My Swing Trading Strategy

I sold my position yesterday in SPXU for a +1.5%. Not as much as I would have liked from the trade, but I also found it hard to justify holding it another day without the market showing a strong propensity to want to go lower. I may jump back in, if the market conditions warrant a sell-off. Otherwise, I will start looking for potential bounce candidates.

Indicators

- Volatility Index (VIX) – VIX managed to rally 3% yesterday, but well off the highs of the day, as the early weakness quickly reversed into an afternoon rally. It may be ready to bounce, but the indicator is likely to stay muted until some news hits on China, or first quarter earnings kicks off.

- T2108 (% of stocks trading above their 40-day moving average): A 4% decline yesterday, to take the indicator back below 50%. Still flashing a rollover, but the moves are getting smaller.

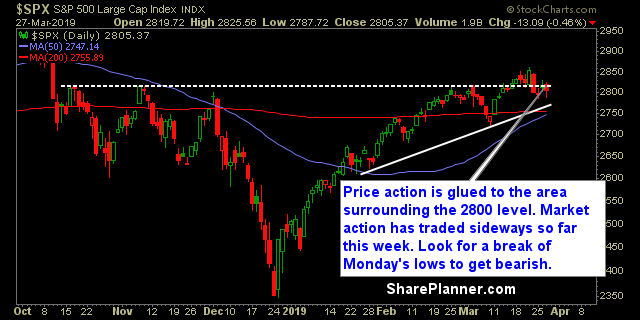

- Moving averages (SPX): Managing to hold the 20-day moving average but unable to break back above the 5 and 10-day MA’s.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Led by strength in Boeing (BA), Industrials managed to be the only sector to finish in positive territory yesterday. Technology leading to the downside with a much bigger pullback than the broader market. But over the last seven trading sessions, Financials are by far the weakest and should be avoided. Much of the market this week have simply been trading sideways.

My Market Sentiment

Plenty of indecision in this stock market. I would have thought the bears would have been able to drive this market lower following Friday’s steep sell-off, but the market has managed to trade sideways in a very unexciting way. Patience is key here, and to not force trades that aren’t there.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.