My Swing Trading Approach

Following an epic rally in equities yesterday, I am going to stand back and watch the price action this morning, to see whether continuation is in the cards today. I sold NFLX yesterday in the morning for a +1.3% profit, but quickly jumped back in following Powell’s positive comments and now I’m sitting with +5.2% currently in profits. I also added one additional trade, but has yet to make a move for me.

Indicators

- Volatility Index (VIX) – Despite the massive rally, VIX only dropped 2.8%, which is quite surprising. It managed to test the 50-day moving average and hold it. VIX likely consolidating as it waits for the outcome of the G20 Summit.

- T2108 (% of stocks trading above their 40-day moving average): Huge rally of 36%, sending the indicator out of its bull flag and up to 43, and the highest closing since 9/25, before the huge market sell-off started.

- Moving averages (SPX): Broke though the 5-day and 20-day moving averages with conviction. Needs to hold these levels today. Challenge of the 50-day and 200-day moving averages looks likely in the near future.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Every sector besides Utilities, which was expected, participated in the rally yesterday. Technology rallied over 3.2% and led the charge higher, but there is no new higher-high established yet, which makes it incredibly important for the bulls that the rally continues to push higher. Healthcare broke through the 50-day moving average and close to nearing a break of the inverse head and shoulders neckline. Potential double bottom in Basic Materials brewing. Financials has established a higher-low, and not to far off from a higher-high, and therefore a new rising trend-line being put in place.

My Market Sentiment

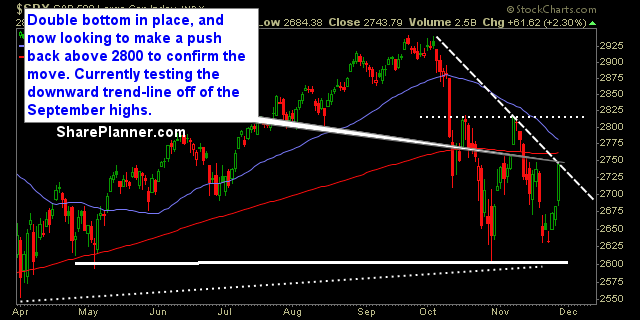

The downward trend-line on SPX from the September highs, are being tested here, and breaking it will be key today for sustaining the rally at hand. A move back over 2800 would confirm the double bottom. Huge improvement yesterday in the health of this market, but Saturday’s G20 summit will absolutely be key to the sustainability of this market next week.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.