My Swing Trading Approach

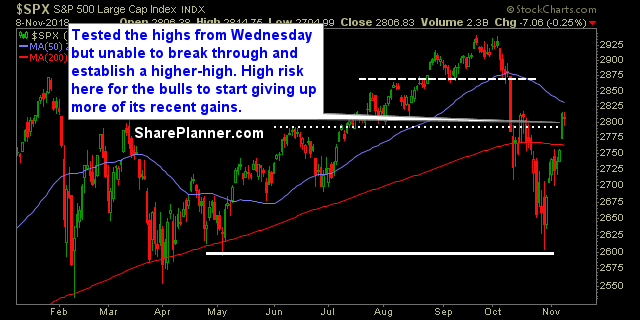

I plan to let the stop-losses in my existing long positions do their work, while my one short position should help to mitigate any of their losses. A major sell-off today that would put price back into the gap from Wednesday’s price action and would likely stir the bears to start shorting aggressively once again. I will consider increasing my short exposure should the market show continued weakness today.

Friday’s Swing-Trade Ideas:

Take a look at three trading ideas to prep you for the trading session.

Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself!

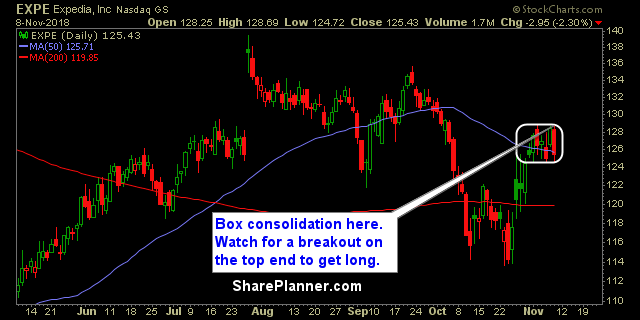

Long Expedia (EXPE)

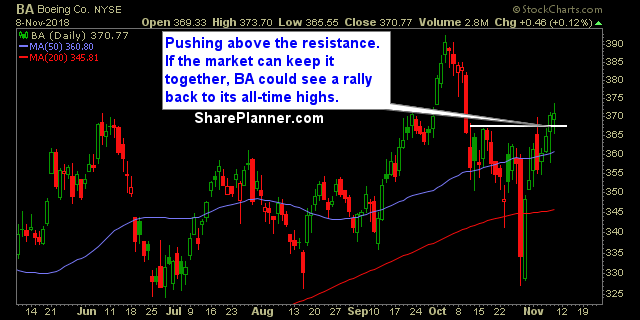

Long Boeing (BA)

RELATED: My Patterns to Profits Training Course

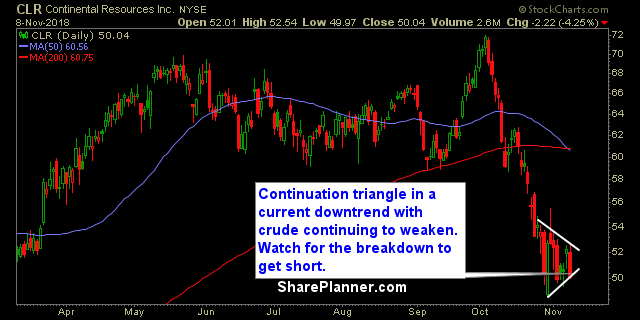

Short Continental Resources (CLR)

Indicators

- Volatility Index (VIX) – A 2.2% rally yesterday, to keep the sell-off at bay for a day. VIX showing signs of wanting to rally today amid a gap lower at the open for the major indices.

- T2108 (% of stocks trading above their 40-day moving average): Indicator held up very well and in line with what one would expect with a meager amount of selling yesterday. Current sitting at 40%.

- Moving averages (SPX): No damage yesterday on the charts but has yet to test the 50-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials continue to be the market’s hottest sector of late, rising for a ninth consecutive day, but extremely stretched here. Utilities probably the most bullish chart over the past two months as it continues to establish higher-highs and higher-lows during that time period, which is pretty impressive considering the market conditions. Industrials look as if it could easily resume its downtrend, as it is nowhere near making a higher-high. The same could be said about Technology too. Materials struggling around overhead resistance and probably the most bearish chart, coupled with Energy.

My Market Sentiment

Following a rally of more than 200 points, the bulls are showing signs of trying to weaken once again for the same reasons – Fed, China and the continued sell-off in oil. I didn’t add any long positions yesterday and have tightened up the stops.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions, 1 Short Position

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.