My Swing Trading Approach

I added one additional long position yesterday to the portfolio, and will increase the stop-loss in both positions to protect profits. I will look to add a new position today, if the bulls can keep a handle on the market.

Indicators

- Volatility Index (VIX) – Hard reversal yesterday, with a 17.3% decline taking the VIX back down to 17.62. Well off of its highs in the 28’s, last week. Likely to see 14-15 range again before finding support.

- T2108 (% of stocks trading above their 40-day moving average): Massive rally of 58% – typical of a market bounce, taking it back up to 21% overall.

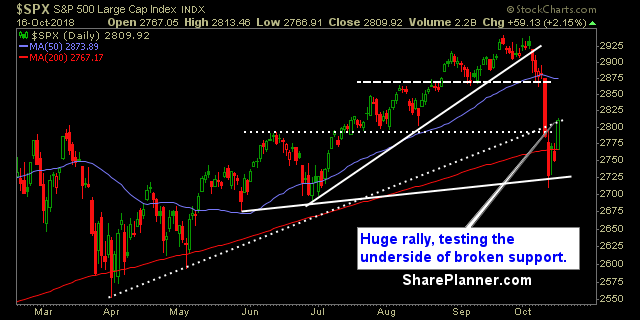

- Moving averages (SPX): Recaptured the 200-day moving average, as well as the steep, declining 5-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Massive rally in Technology yesterday, which was absolutely critical to sustain the market bounce, while also recovering much of the losses from Wednesday and Thursday. Major rally in Healthcare as well and a market leader as long as this rally holds out. Discretionary bounced, but still has some resistance back from the lows established in July and August that needs to be broken. While Energy and Materials both bounced yesterday, it lagged the rest of the market.

My Market Sentiment

It looks to me that this market has more upside to the bounce. Whether the bounce can be sustained into next week, remains a mystery, but the market is just starting to come out of oversold conditions here, with plenty of room to squeeze the shorts. With that said, don’t let go of profits when you have them and managing risk remains critical in these market conditions. So do it!

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.