My Swing Trading Approach

I closed out AMZN for a +3.4% and GOOGL for a small profit. I would have liked to of held them longer, but I had to make sure that if the market was going to tank midday like it did, that it didn’t take my profits with them. I added another long position later in the day, and have some profits I am working with there. I will look to add another long position to the portfolio today, but also be aware of the strong potential for a dead cat bounce.

Indicators

- Volatility Index (VIX) – 14.7% decline on Friday, wiping out all of Thursday’s gains. Reversal pattern in play here to the downside.

- T2108 (% of stocks trading above their 40-day moving average): Insanely low and went into the single digits – as low as 9.4%. Historically, single digits are a rare feat, and offer some of the greatest bounce opportunities for the indices.

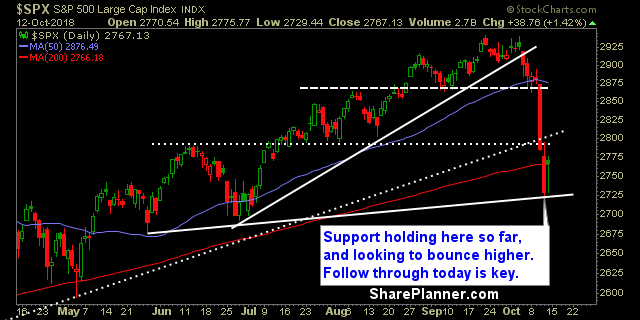

- Moving averages (SPX): Broke back above the 200-day moving average, but barely holding it. Follow through is key for today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the biggest winner on the day, Friday. Huge bounce, and recovered about half the losses of the previous two trading sessions. All of the sectors rallied, but I would stay away from Utilities on further upside out of this market, and Industrials and Financials struggling was surprising, and barely participated.

My Market Sentiment

Friday’s bounce was expected as conditions were extremely oversold, but the bounce didn’t exude confidence, and the breadth wasn’t that great. Follow through is extremely important today, to instill some confidence in the short-term sustainability of a bounce.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Long Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.