My Swing Trading Approach

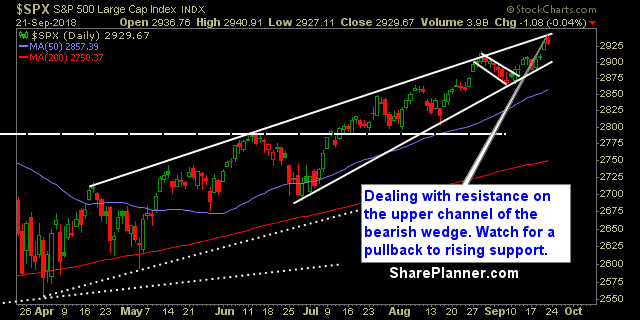

I am concerned the bulls are running out of steam here, and while, I can still be motivated to add more long positions to my portfolio, I will need to see the action in the broader market show the willingness to break through some overhead resistance.

Indicators

- Volatility Index (VIX) – Dropped 1% on Friday, but could very well be setting up again for a breakout to the upside.

- T2108 (% of stocks trading above their 40-day moving average): Flat day for the indicator, but only 53% of stocks are trading above their 40-day moving average, while SPX and Dow are hitting new all-time highs.

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy continues to be the hot sector, rising in each of the last six trading sessions. Now it is testing resistance, that if broken, will lead to an upside breakout and make a number of energy stocks an ideal trade. Utilities bouncing back after last week’s brutal sell-off. Industrials continue their impressive rally, but could start to tire out here. Materials looking to confirm a double bottom pattern in the short-term. Technology still a mixed bag and lagging the overall market.

My Market Sentiment

I remain bullish, but watching carefully the bearish wedge – the bulls will need to break through that level of resistance today if it plans to keep the momentum from last week going. Otherwise, we risk a pullback to the rising trend-line from the June lows.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.