My Swing Trading Approach

Another position was added yesterday, with a solid spread across the market’s sectors (i.e. I’m not trading anything that’s in the financials or materials). Again, I will continue tightening the stop-loss on my existing positions, but adding anything new to the portfolio at this point, will require a lot of strength and conviction from the market. Otherwise, I will be focused solely on my existing trades.

Indicators

- Volatility Index (VIX) – Dropped for a fourth straight day, to the tune of 5.9%. Setting up for a move down to the 11.90’s.

- T2108 (% of stocks trading above their 40-day moving average): Barely a move yesterday, really no move at all. This is troubling as breadth is very weak over the last four trading sessions, despite SPX rallying during that time.

- Moving averages (SPX): Broke back above the 10-day MA and now trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the market leader yesterday, and looks to retest its all-time highs here very soon. Telecom has been the most bullish of all the sectors this week – very strong and breaking out of its base. Healthcare broke out of its bull flag pattern. Materials, Financials and Energy does not look inspiring at all.

My Market Sentiment

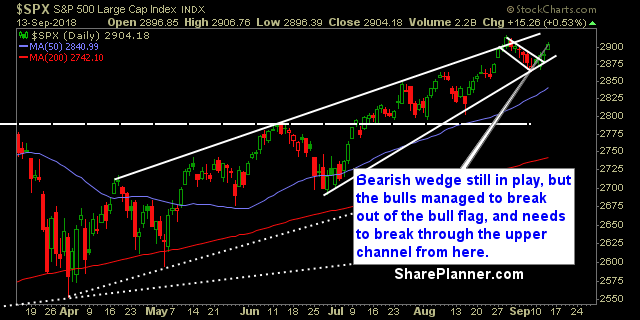

The breadth continues to be a theme for the market this week, and has often led to eventual reversals, particularly this year. There is a bearish wedge in place, and price will need to break out of the upside here very soon, to negate the pattern.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 5 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.