My Swing Trading Approach

I am taking a wait and see approach following Tuesday’s head fake. The market needs to build some credibility with me today that it can sustain its gains, before I go adding something new again. Tuesday’s price action didn’t make for ideal trading conditions, and instead of committing more capital, I will look to remain on the sidelines today.

Indicators

- VIX – Recovered from Monday’s losses, with a 3.5% increase. Still within a 7-day range and could still make a move for 20 here.

- T2108 (% of stocks trading above their 40-day moving average): 7% bounce to 52%. Still facing some resistance at the 56% level.

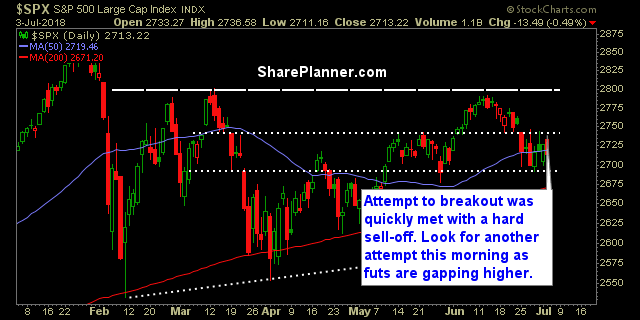

- Moving averages (SPX): Opened above the 10-day moving average, but by the end of the day, dropped back below the 50-day and 5-day MA as well.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology really got beat up on Tuesday. Energy and Materials re-emerged as the market leaders after getting ripped apart in the day prior. Discretionary has been floating without real conviction of late. Financials could be staging another move lower here.

My Market Sentiment

Tuesday’s afternoon sell-off really cramped the market going forward, so that today would be quite a wild card as to what it would do. Futures are pointing higher, but morning gaps higher have had a tendency to get quickly filled and thereby casting some skepticism on whether the market can hold it together today.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan gives a dire warning to traders in this stock market who are continuing to bid up stock prices believing that a major market bottom has been put in place, using reckless trading strategies and piling into overvalued stock trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.