My Swing Trading Approach

I am going to play it careful here with the weakness seen this morning. I won’t rule out going short, but I will play it safe until a solid opportunity arises. Not looking to push anything here. Less is more here.

Indicators

- VIX – Coiling over the last five trading sessions in an elevated manner. Today’s weakness, could see a push for 20 again.

- T2108 (% of stocks trading above their 40-day moving average): While trading higher on Friday, the T2108 is still showing notable weakness. Down to 48.5%

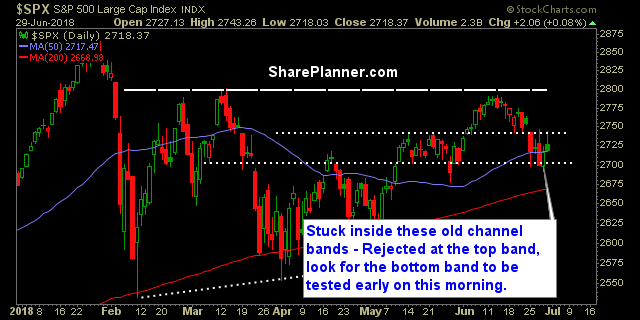

- Moving averages (SPX): Still trading above the 50-day moving average, but will break below it this morning at the open. A potential retest of the 200-day MA is possible here.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy and Materials show the most strength on Friday, with the former being the strongest sector from last week. The latter, along with Industrials continues to trade in a sideways trading pattern going all the way back to February. Healthcare continues to display a rising trend-line on the daily with higher-highs and higher-lows. Technology is the one to watch here, as it is testing a key support level over the last two days. Bull Flag in Utilities. Financials, of all sectors, is the worst one to be trading in right now.

My Market Sentiment

A nasty 19 point sell-off in the final hour of trading to close out the quarter, despite trading well in the green for the entire day, prior to. As a result a shooting star candle pattern has emerged, that can signal more downside to come for the market, and we are seeing that with additional pre-market weakness this morning, just like we saw last Monday, too. Holiday weeks tend to be low volume, bullish weeks historically. The market is definitely oversold in the near term, and may be setting up for a bounce here.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.