My Swing Trading Approach

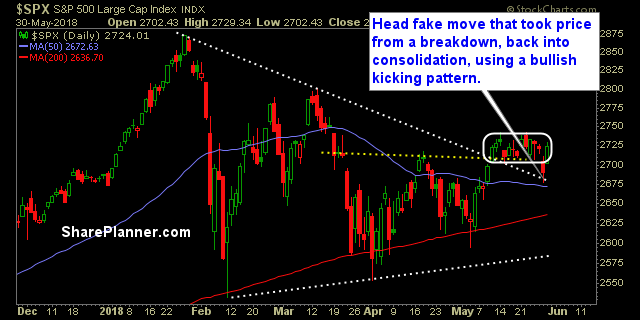

Huge bullish kicking candle pattern the last two days with the S&P 500 (okay, maybe not a perfect one, but close enough). I am optimistic, the bulls will try to put together a sustainable move here going forward and will add more positions as long as the market is a willing participant.

Indicators

- VIX – Inside day for the VIX, but much of the prior day’s gains was wiped out yesterday. Back below 15.

- T2108 (% of stocks trading below their 40-day moving average): Huge push yesterday – up 15% and now at 67%. Huge move for the indicator, and bodes well for continued improvement.

- Moving averages (SPX): Recaptured the 5, 10 and 20 day moving averages yesterday and now above all the major MA’s.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Huge bounce in Energy yesterday, and probably shows the most upside opportunity at this point. Healthcare breaking out of consolidation, as is Real Estate. Technology and Discretionary should be the next two sectors to breakout.

My Market Sentiment

It is like Tuesday never happened. The market essentially wiped out a massive sell-off in one day, ignored the technical damage that it created, and sent price right back into recent consolidation. Stay bullish here.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.