My Swing Trading Approach

I have one short position. I plan to play it cautious here. If the bulls choose to rally, the market today, I will look to add some long exposure, but plan, for now, to keep the short position as long as possible. Some technical damage on the SPX chart warrants that a more conservative approach is warranted here.

Indicators

- VIX – Massive, massive rally yesterday of 29% to just over 17. Highest close since 4/26. Another big move today could send it over 20.

- T2108 (% of stocks trading below their 40-day moving average): Dropped 8.8% yesterday and back below 60%, to 58%. Also broke below the rising uptrend off of the February lows.

- Moving averages (SPX): On top of losing the 5-day and 10-day on Friday, yesterday it lost the 20-day moving average as well.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Real Estate was was the only sector to finish higher, and right now, one of the best looking charts. Huge breakdown in Financials yesterday, while also breaking below the 200-day moving average for the first time this year. You could test the closing lows today. Clearly the worst performing sector and should only be look at for shorting opportunities. Still waiting for the bounce in oil. Looks like it is setting up for one. Technology did not experience the same breakdown that the rest of the market saw yesterday – still in good shape.

My Market Sentiment

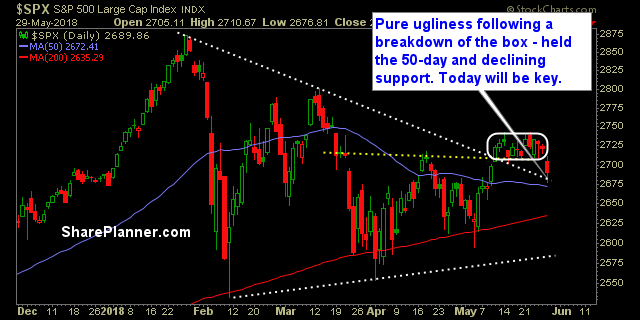

Big day on the market that also included a significant increase in volume while breaking down through key consolidation. So far the 50-day moving average is holding, but that may be in play today. Early strength in the futures, watch to see whether it is faded at the open.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Short Position

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.