My Swing Trading Approach

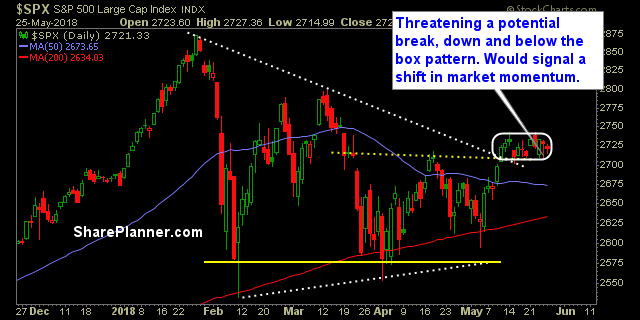

Considering what the market does with the current consolidation pattern, a breakdown may warrant some short exposure. I may have some opportunity on the dip buy, but overall, a conservative approach to the long side will likely be necessary today.

Indicators

- VIX – Solid bounce on Friday, but some solid resistance at the 200-day MA.

- T2108 (% of stocks trading below their 40-day moving average): Not able to remain above the 66% level, but not giving up much ground either. Remains at 64%

- Moving averages (SPX): Broke below the 5-day and 10-day moving averages.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Real Estate and Utilities headed up the large majority of the market strength present on Friday. The former of which continues to put in a series of higher-highs and higher-lows. Technology also sporting a solid bull flag pattern, while Discretionary continues to march higher, but at a slower pace. Healthcare on the verge of a breakout, but I would stay away from Energy until some stabilizing can be seen. Some bounce opportunities are starting to arise.

My Market Sentiment

A little bit surprising the Italian Political Risks is having on the the US market this morning. There has been little to no interest by the market up to this point. Nonetheless, it puts the current consolidation pattern below at risk of a breakdown – the key will be where price closes at.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.