My Swing Trading Approach

I reduced my long exposure some on Friday, but still maintain 30% long and 70% cash. So if the market gap higher this morning can hold up, I’ll look to add more to the long side.

Indicators

- VIX – Sold off hard to the downside. Friday sold off another 5.8% and now in a free-fall as it broke down and out of recent consolidation.

- T2108 (% of stocks trading below their 40-day moving average): Sticking near the recent highs, and not breaking down at all. Stocks as a whole are trying to improve, with 46% now trading above their 40-day MA.

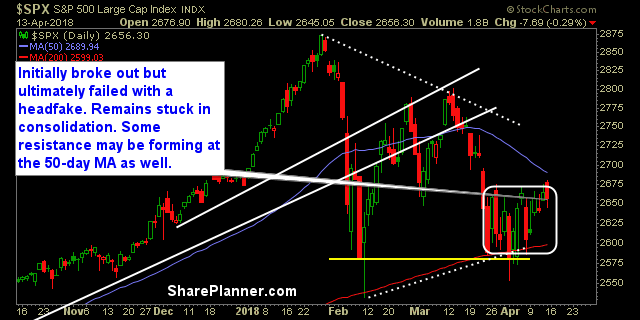

- Moving averages (SPX): Tested and held the 5 and 20-day moving averages. Nearing a test of the 50-day moving average. A break of that MA would be a big deal for the market.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Utilities led the way, followed by Energy and Real Estate. Financials had the biggest hit, and suddenly looks very problematic following the first batch of earnings released on Friday.

My Market Sentiment

Friday started off well for the bulls, but the lack of follow through and ultimately the head fake that ensued, continues to frustrate traders. Breaking out of the box will continue to be key for traders moving forward and establishing a firm direction for the market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.