My Swing Trading Approach

I am still playing this market cautiously. I will consider adding another long position to the portfolio, but won’t do it on anything less than ideal trading conditions. Right now the headline risk is notable, and prevents any significant long exposure in this market.

Indicators

- VIX – Saw a 1.1% decline despite the market engaging in a sell-off of its own. Nearing a break below of 20, as it currently sits at 20.24.

- T2108 (% of stocks trading below their 40-day moving average): Another bullish outcome in T2108 yesterday. Rose about 1% despite a market sell-off. These bullish divergences continue to pop up on this indicator.

- Moving averages (SPX): The 20-day moving average continues to resist any breakout to the upside. Today will be another test of the stubborn MA.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Energy remains the strongest sector in the market as its breakout is well underway now. I regret to a certain extent not trading this particular sector, but I made a decision to avoid the less dependable sectors and focus on the best sectors of the past year when trading the bounces in this market. Real Estate remains strong, as well as Utilities, as they both continue to establish higher-highs and higher-lows off the February lows. Financials continues to struggle with the bounce off the lows.

My Market Sentiment

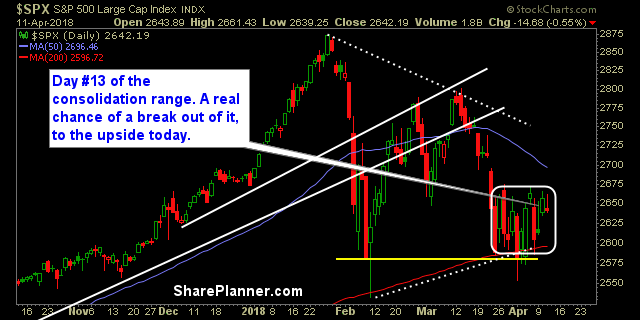

Price action on SPX still remains stuck in a strong price consolidation pattern. Today’s pre-market strength may lead us into an upside break and drive the market notably higher and squeezing the shorts along the way.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.