My Swing Trading Approach

Booked profits in a number of positions on Friday, reduced my long exposure, day-traded the market to the short side. Should the market rally, and hold the rally today, I will look to add some new long positions to the portfolio.

Indicators

- VIX – A 13% rally yesterday, back above 20, but stuck in consolidation over the last two weeks.

- T2108 (% of stocks trading below their 40-day moving average): Significant drop in indicator on Friday of 25% down to 37.6% overall. Higher-highs remain in place.

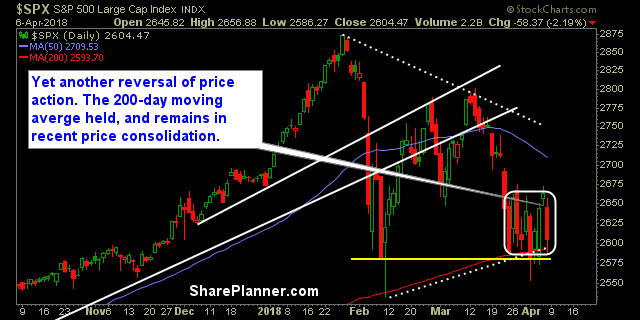

- Moving averages (SPX): Lost the 5-and 10-day moving averages, but held on to the 200-day moving average.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Like most sell-offs of late, Industrials, Technology and Healthcare led the way to the downside, while Utilities and Real Estate were near the top. Energy was on the brink of a significant breakout, but squandered the opportunity on Friday. Materials continues to put in lower-highs.

My Market Sentiment

Dramatic price action of rallies and reversals happening spontaneously on market headlines. The headline risk is incredibly high at the moment. Despite Friday’s reversal in price, the 200-day moving average still held with a 20-point rally off of the lows of the day. Price also remains stuck in a two week consolidation pattern.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long Positions