My Swing Trading Approach

With the overnight sell-off, I will take a wait and see approach. I’ll remain patient and wait for a clear sign from the market that the selling will not extend itself lower, before considering any new long positions.

Indicators

- VIX – Quiet day in the market and as a result, hardly any movement out of the VIX, dropping 2% down to 18.36. Still elevated above the norm of what we saw throughout 2017.

- T2108 (% of stocks trading below their 40-day moving average): Continued improvement and solid breadth in the market has t2108 up another 13% yesterday. Stocks overall though as still lagging.

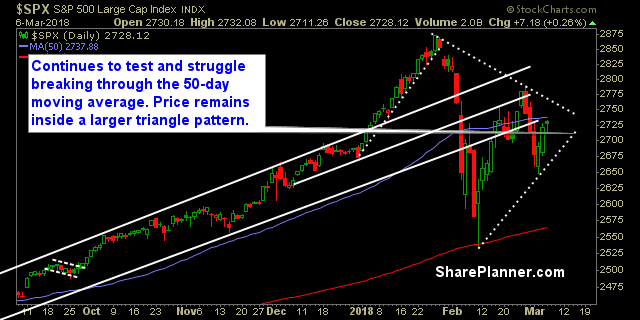

- Moving averages (SPX): 50-day moving average unable to break through for the third time in the last four trading sessions. 5, 10 and 20-day moving averages are at risk today.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Utilities was back at the bottom as traders rotated out of that sector and into Basic Materials, Consumer Cyclical, and Technology. The latter of which is sitting at all-time highs. Energy with the double bottom, still struggling to make a substantial move.

My Market Sentiment

Triangle pattern still in play. A break either way will define market action going forward.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long positions