My Swing Trading Approach

Three day weekend ahead of us, with the market closed on Monday. I may add a new position if the market holds the early morning gains, and the right opportunity presents itself. I will continue increasing my stops to protect profits.

Indicators

- VIX – Even with yesterday’s rally in equities, the VIX still rose 0.6% to 9.88.

- T2108 (% of stocks trading below their 40-day moving average): Finally a BIG MOVE! Rose 8.6% yesterday to close at 69%. Still has room to move higher, but the bearish divergence is looking less threatening with that move yesterday.

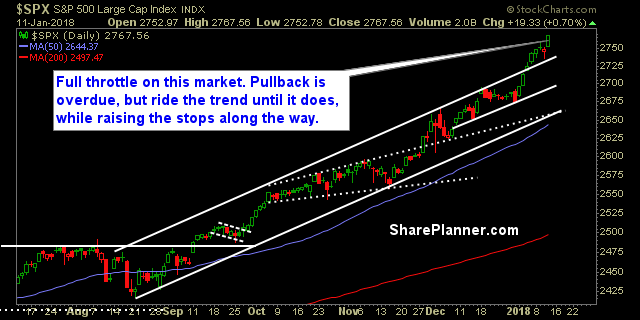

- Moving averages (SPX): Still holding on to the 5-day moving average and all the other MA’s.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Energy remains the strongest sector, with Basic Materials right behind. Both are sporting parabolic trend lines. Technology consolidated over the past five days.

My Market Sentiment

Keep riding the trend. Don’t be irrational along the way, but move those stops up. It won’t last forever, so always be prepared.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 5 long positions

Recent Stock Trade Notables:

- Fifth Third Bancorp (FITB): Long at 30.92, sold at 31.80 for a 2.9% profit.

- US Steel (X): Long at 35.38, sold at 36.90 for a 4.3% profit.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I continue the two-part series on the rise of the retail trader and the growing impact they have in today's stock market. I also talk about how this impacts your trading and the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.