Swing Trade Approach:

Some seasonal factors starting to hit this market strong. Yes, this is usually a bullish time for the market at this time of the year, and we are seeing nothing short of that. With the Fed blowing the top off with repo purchases, this market is likely to buck all reason and push higher. You saw FOMO hit the market hard into the close with a nice pop. Right now, you want to be raising your stops, even taking some profits off the table as the market continues its rise. Any new positions added to the portfolio should be done with the house’s money at this point, and not over extending yourself.

Indicators

- Volatility Index (VIX) – Spent most of the day in positive territory but a market rally in the last 10 minutes pushed this index 0.6% lower on the day.

- T2108 (% of stocks trading above their 40-day moving average): Finally starting to trend higher, but still nowhere near the levels we saw in much less bullish times like the July and September highs.

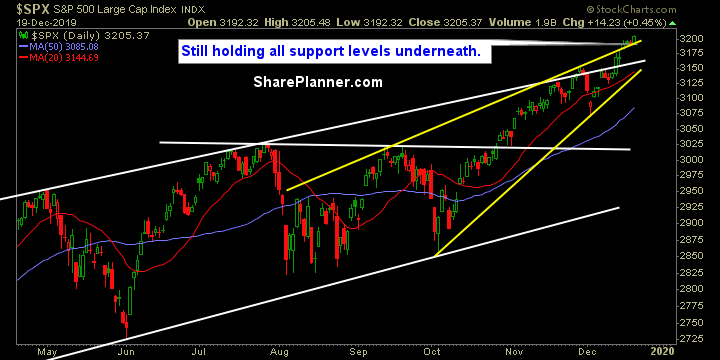

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy not leading the way as it has of late, but did manage to break through its 200-day moving average and that, in and of itself, is quite impressive. Materials and Utilities could not muster any real gains today, but Technology held up well all day long and, along with Real Estate, managed to close at their highs of the day, and keep the market rallying.

My Market Sentiment

At this juncture, the market simply cannot break any levels of support – small or large. All dips to any support level continues to get bought up as was seen today as SPX continues to impossibly hold the steepest of trend-lines.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode Ryan talks about not allocating all of your capital to one single trade. He covers why it is dangerous to your trading and the sustainability of that strategy long-term. Also covered is how much should you dedicate to long-term vs short-term trading, and whether you should ditch one approach for the other.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.