My Swing Trades

A bunch of trade setups triggered today in the Splash Zone. One in particular that was my favorite was the almost 6% pop in Trinity Industries (TRN). Still waiting for Splunk (SPLK) to break out but long last it looks like it is falling apart without ever the chance of breaking out of the continuation triangle pattern it was in. Another favorite continues to be Graco (GGG) but likely to see some resistance in the $50-51 range.

Indicators

- Volatility Index (VIX) – Starting to give up its big gains from Monday for the past two days. Disappointing because this market could actually use a little volatility to shake things up. Currently at 15 on a 4.4% drop.

- T2108 (% of stocks trading above their 40-day moving average): Can’t go higher, and can’t seem to sustain a move lower. Just stuck in the eternal 50% range.

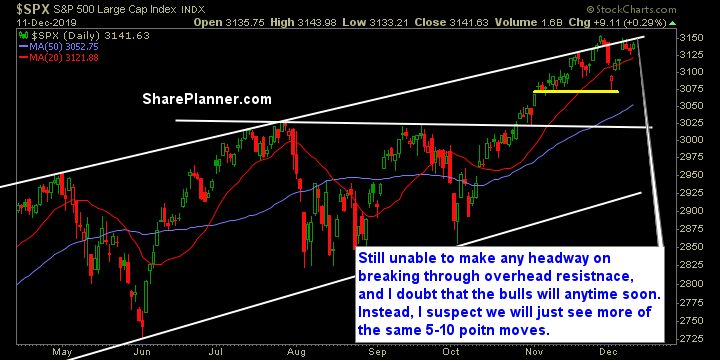

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy finally handed over the baton to Materials today. I still think the former has some potential upside to it, but needs to definitively break through the heavy resistance created by the downtrend off of the April highs. Healthcare continues to consolidate at its all-time highs. Very healthy chart with the consolidation unfolding and setting up for another push higher.

My Market Sentiment

You have rising resistance overhead that continues to stunt any major price moves to the upside and this has been going on for the better part of a month now. Until that changes, I expect the market to have price moves that are very measured and contained.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode Ryan talks about not allocating all of your capital to one single trade. He covers why it is dangerous to your trading and the sustainability of that strategy long-term. Also covered is how much should you dedicate to long-term vs short-term trading, and whether you should ditch one approach for the other.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.